Advancements in Sensor Technology

Technological advancements in sensor technology are significantly influencing the UK Data Acquisition Daq System Market. The proliferation of high-precision sensors has enabled more accurate data collection across various applications, including environmental monitoring, industrial automation, and smart cities. The integration of these advanced sensors into Daq systems enhances their functionality and reliability, making them indispensable tools for data-driven decision-making. For instance, the UK government has invested in smart city initiatives that utilize sophisticated sensors to monitor urban environments, thereby driving the demand for advanced data acquisition systems. As sensor technology continues to evolve, it is expected that the capabilities of Daq systems will expand, further propelling market growth.

Growth of the Renewable Energy Sector

The growth of the renewable energy sector in the UK is significantly impacting the Data Acquisition Daq System Market. As the country transitions towards sustainable energy sources, there is an increasing need for efficient data acquisition systems to monitor and optimize energy production from renewable sources such as wind and solar. The UK government has set ambitious targets for renewable energy generation, which necessitates the deployment of advanced Daq systems to ensure optimal performance and reliability. Market analysts project that the renewable energy sector will require a substantial investment in data acquisition technologies, potentially exceeding GBP 1 billion by 2028. This trend indicates a robust opportunity for Daq system providers to cater to the evolving needs of the energy sector.

Increased Focus on Environmental Monitoring

The UK Data Acquisition Daq System Market is witnessing a heightened focus on environmental monitoring, driven by regulatory requirements and public awareness of sustainability issues. The UK government has implemented stringent environmental regulations that necessitate accurate data collection and reporting. This has led to an increased demand for Daq systems capable of monitoring air quality, water quality, and other environmental parameters. According to the Environment Agency, the need for effective environmental monitoring solutions is critical for compliance with regulations and for informing policy decisions. As organizations strive to meet these regulatory demands, the market for data acquisition systems tailored for environmental applications is likely to expand, presenting opportunities for innovation and growth.

Rising Demand for Real-Time Data Processing

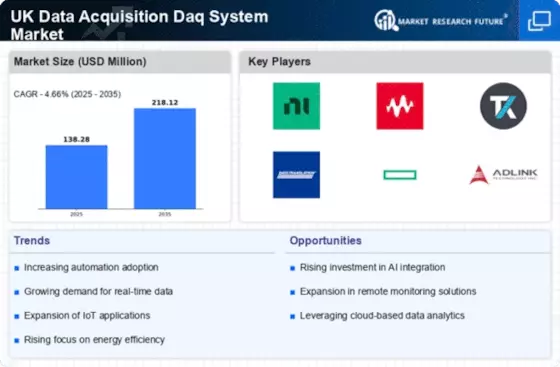

The UK Data Acquisition Daq System Market is experiencing a notable increase in demand for real-time data processing capabilities. Industries such as manufacturing, healthcare, and energy are increasingly reliant on timely data to enhance operational efficiency and decision-making. According to recent statistics, the market for data acquisition systems in the UK is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% over the next five years. This growth is driven by the need for immediate insights and the ability to respond swiftly to changing conditions, which is particularly critical in sectors like healthcare where patient monitoring is paramount. As organizations seek to leverage data for competitive advantage, the demand for advanced Daq systems that can facilitate real-time data acquisition is likely to intensify.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies into data acquisition systems is transforming the UK Data Acquisition Daq System Market. These technologies enable more sophisticated data analysis, predictive maintenance, and enhanced automation capabilities. As industries increasingly adopt AI and ML, the demand for Daq systems that can seamlessly integrate with these technologies is likely to rise. For example, manufacturing sectors are leveraging AI-driven analytics to optimize production processes, thereby increasing the need for advanced data acquisition solutions. The UK government is also promoting AI initiatives, which may further stimulate market growth. As organizations seek to harness the power of AI and ML, the Daq system market is poised for significant advancements.