Rising Public Health Awareness

The covid 19-diagnostics market in the UK is experiencing a notable surge in demand due to heightened public health awareness. The ongoing emphasis on health and safety measures has led to an increased understanding of the importance of timely diagnostics. This awareness is reflected in the growing number of individuals seeking testing services, which has reportedly increased by approximately 30% over the past year. As citizens become more proactive about their health, the market is likely to see sustained growth. Furthermore, educational campaigns by health authorities are contributing to this trend, encouraging regular testing and early detection. The covid 19-diagnostics market is thus positioned to benefit from this shift in public perception, as more individuals prioritize their health and seek out diagnostic solutions.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the covid 19-diagnostics market in the UK. The UK government has allocated substantial funding to enhance testing capabilities, which has been pivotal in expanding the market. Recent reports indicate that funding has increased by over £500 million to support the development and distribution of diagnostic tests. This financial backing not only facilitates research and development but also ensures that testing remains accessible to the public. Additionally, government-led programs aimed at increasing testing in underserved areas are likely to further stimulate market growth. The covid 19-diagnostics market is thus benefiting from these strategic investments, which aim to bolster public health infrastructure and ensure widespread access to testing.

Technological Innovations in Testing

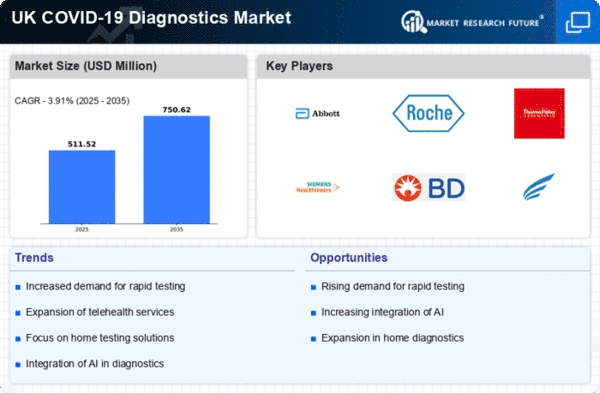

Technological innovations are significantly influencing the covid 19-diagnostics market in the UK. The introduction of advanced testing methods, such as rapid antigen tests and PCR technology, has revolutionized the diagnostic landscape. These innovations have not only improved the accuracy and speed of testing but have also made it more convenient for users. For instance, rapid tests can deliver results within 15 minutes, which is a substantial improvement over traditional methods. The market is projected to grow by approximately 25% in the next year, driven by these technological advancements. As the covid 19-diagnostics market continues to evolve, the integration of cutting-edge technology is likely to enhance testing capabilities and improve overall public health outcomes.

Increased Focus on Preventive Healthcare

The covid 19-diagnostics market in the UK is witnessing a shift towards preventive healthcare, which is reshaping consumer behavior. Individuals are increasingly recognizing the value of early detection and preventive measures in managing health. This trend is reflected in the rising demand for regular testing, as people seek to identify potential health issues before they escalate. The market is expected to expand as healthcare providers promote preventive strategies, including routine testing for covid 19. This proactive approach not only benefits individual health but also contributes to the overall efficiency of the healthcare system. The covid 19-diagnostics market is thus likely to thrive as preventive healthcare becomes a priority for both consumers and providers.

Emerging Market for At-Home Testing Solutions

The covid 19-diagnostics market in the UK is experiencing a transformation with the emergence of at-home testing solutions. The convenience and privacy offered by these tests are appealing to consumers, leading to a notable increase in their adoption. Recent data suggests that at-home testing kits have seen a growth rate of approximately 40% in sales over the past year. This trend is likely to continue as more individuals prefer the flexibility of testing from home. The covid 19-diagnostics market is adapting to this demand by developing user-friendly testing kits that provide accurate results. As the market evolves, the focus on at-home solutions is expected to drive further growth and innovation.