Growing Demand for Scalability

The cloud migration-services market experiences a notable surge in demand for scalability solutions. As businesses in the UK increasingly seek to adapt to fluctuating market conditions, the ability to scale resources up or down becomes paramount. This trend is particularly evident in sectors such as retail and finance, where operational flexibility is crucial. According to recent data, approximately 70% of UK enterprises indicate that scalability is a primary driver for their cloud migration initiatives. The cloud migration-services market thus positions itself as a vital enabler, allowing organisations to efficiently manage their resources and costs while responding to market dynamics.

Cost Efficiency and Resource Optimisation

Cost efficiency remains a pivotal driver in the cloud migration-services market. UK businesses are increasingly recognising the financial benefits associated with migrating to cloud environments. By leveraging cloud services, organisations can reduce their IT infrastructure costs by up to 30%, as reported by various industry analyses. This financial incentive is compelling, particularly for small to medium-sized enterprises (SMEs) that often operate with limited budgets. The cloud migration-services market facilitates this transition, providing tailored solutions that optimise resource allocation and minimise operational expenses, thereby enhancing overall profitability.

Regulatory Compliance and Data Sovereignty

Regulatory compliance and data sovereignty are critical drivers in the cloud migration-services market. UK organisations face stringent regulations regarding data protection and privacy, such as the General Data Protection Regulation (GDPR). As a result, businesses are increasingly migrating to cloud solutions that ensure compliance with these regulations. The cloud migration-services market offers tailored services that address these compliance needs, providing organisations with the assurance that their data is managed in accordance with legal requirements. This focus on regulatory adherence is likely to continue influencing migration strategies in the coming years.

Technological Advancements in Cloud Solutions

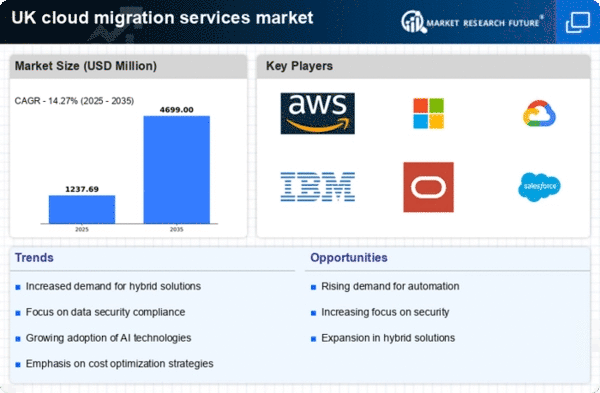

Technological advancements play a crucial role in shaping the cloud migration-services market. Innovations such as artificial intelligence (AI) and machine learning (ML) are increasingly integrated into cloud platforms, enhancing their capabilities. UK businesses are keen to leverage these technologies to improve operational efficiency and data analytics. The cloud migration-services market is thus positioned to benefit from this trend, as organisations seek to adopt cutting-edge solutions that can provide a competitive edge. It is estimated that by 2026, the integration of AI in cloud services could increase market growth by approximately 25%.

Enhanced Collaboration and Remote Work Capabilities

The cloud migration-services market is significantly influenced by the need for enhanced collaboration and remote work capabilities. As UK organisations embrace flexible working arrangements, the demand for cloud-based tools that facilitate seamless communication and collaboration has surged. Approximately 65% of UK companies report that cloud solutions have improved their team collaboration, enabling employees to work efficiently from various locations. This shift not only boosts productivity but also drives the adoption of cloud migration services, as businesses seek to integrate these collaborative tools into their existing frameworks.