Emergence of Fintech Partnerships

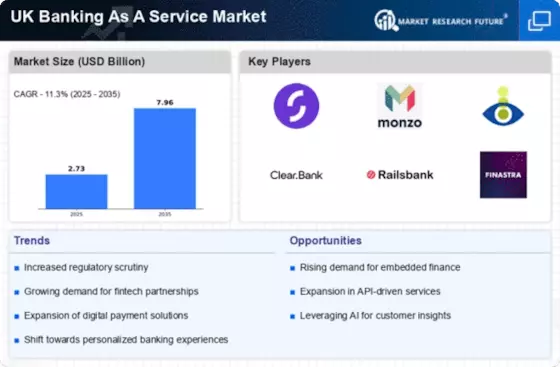

The UK Banking As A Service Market is witnessing a significant trend towards partnerships between traditional banks and fintech companies. These collaborations are designed to leverage the strengths of both sectors, combining the established trust of banks with the innovative capabilities of fintechs. Recent statistics indicate that over 60% of UK banks have engaged in partnerships with fintech firms to enhance their service offerings. Such alliances enable banks to integrate advanced technologies, such as artificial intelligence and blockchain, into their operations, thereby improving efficiency and customer experience. Moreover, these partnerships facilitate the rapid deployment of new services, allowing banks to remain competitive in a fast-evolving market. As the fintech landscape continues to mature, the potential for further collaboration within the UK Banking As A Service Market appears promising, suggesting a future where innovation and traditional banking coexist harmoniously.

Regulatory Support for Innovation

The UK Banking As A Service Market benefits from a regulatory environment that appears increasingly supportive of innovation. The Financial Conduct Authority (FCA) has implemented various initiatives aimed at fostering competition and encouraging the adoption of new technologies. For instance, the FCA's regulatory sandbox allows fintech companies to test their products in a controlled environment, which has led to the emergence of numerous innovative banking solutions. This regulatory framework not only mitigates risks but also enhances consumer trust in new banking models. Furthermore, the UK government has expressed its commitment to maintaining a leading position in the global fintech landscape, which could further stimulate growth in the Banking As A Service sector. As regulations evolve, they are likely to create new opportunities for collaboration between traditional banks and fintech firms, thereby propelling the UK Banking As A Service Market forward.

Consumer Preference for Personalization

In the UK Banking As A Service Market, there is a growing consumer preference for personalized banking experiences. Customers are increasingly seeking tailored financial products and services that cater to their individual needs. Data suggests that approximately 65% of UK consumers are more likely to engage with banks that offer personalized services. This trend is driving banks to adopt Banking As A Service models that enable them to deliver customized solutions efficiently. By utilizing data analytics and machine learning, banks can gain insights into customer behavior and preferences, allowing for the development of targeted offerings. This shift towards personalization not only enhances customer satisfaction but also fosters loyalty, which is crucial in a competitive market. As banks strive to meet these evolving expectations, the UK Banking As A Service Market is likely to see a rise in innovative, customer-centric solutions.

Increased Demand for Digital Banking Solutions

The UK Banking As A Service Market is experiencing a notable surge in demand for digital banking solutions. As consumers increasingly favor online and mobile banking, traditional banks are compelled to adapt their services. According to recent data, over 70% of UK consumers now prefer digital banking channels, which has prompted banks to enhance their digital offerings. This shift is not merely a trend; it reflects a fundamental change in consumer behavior. The rise of neobanks and digital-only financial institutions further illustrates this demand, as they provide seamless, user-friendly experiences. Consequently, established banks are collaborating with technology providers to integrate Banking As A Service solutions, thereby improving customer engagement and retention. This growing inclination towards digital solutions is likely to drive innovation and competition within the UK Banking As A Service Market.

Technological Advancements in Banking Infrastructure

The UK Banking As A Service Market is significantly influenced by rapid technological advancements in banking infrastructure. The adoption of cloud computing, APIs, and advanced data analytics is transforming how banks operate and deliver services. Recent reports indicate that over 50% of UK banks are investing in cloud-based solutions to enhance their operational efficiency and scalability. These technologies enable banks to offer more flexible and responsive services, which are essential in meeting the demands of modern consumers. Furthermore, the integration of APIs allows for seamless connectivity between various financial services, facilitating the development of new products and services. As technology continues to evolve, it is likely to drive further innovation within the UK Banking As A Service Market, creating opportunities for both established banks and emerging fintech companies.