Regulatory Support for Biologics

The regulatory landscape in the UK is becoming increasingly supportive of biologics, which is beneficial for the antibody drug-discovery market. The Medicines and Healthcare products Regulatory Agency (MHRA) has implemented streamlined approval processes for biologics, facilitating faster access to the market. This regulatory environment encourages pharmaceutical companies to invest in research and development of new antibody therapies. Furthermore, the UK government has committed to funding initiatives aimed at fostering innovation in the life sciences sector. As a result, the antibody drug-discovery market is likely to witness a rise in the number of approved therapies, enhancing treatment options for patients and driving market growth.

Growing Investment in Biotechnology

Investment in biotechnology is a critical driver for the antibody drug-discovery market. In the UK, venture capital funding for biotech firms has seen a significant increase, with investments reaching over £1 billion in recent years. This influx of capital is enabling companies to advance their research and development efforts, particularly in the field of monoclonal antibodies. The UK government has also introduced various funding schemes to support biotech innovation, further stimulating growth in the sector. As a result, the antibody drug-discovery market is expected to expand, with numerous new therapies entering the pipeline, thereby enhancing the overall landscape of treatment options available to patients.

Rising Demand for Targeted Therapies

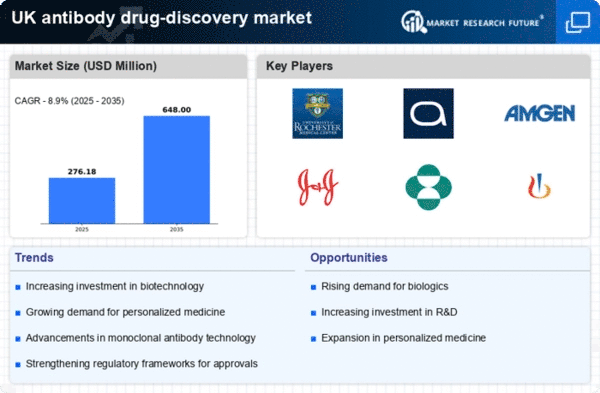

The antibody drug-discovery market is experiencing a notable surge in demand for targeted therapies, driven by the increasing prevalence of chronic diseases such as cancer and autoimmune disorders. In the UK, the National Health Service (NHS) has been actively promoting the use of biologics, which include monoclonal antibodies, as part of its treatment protocols. This shift towards precision medicine is expected to enhance patient outcomes and reduce healthcare costs. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the growing acceptance of antibody-based therapies. As healthcare providers seek more effective treatment options, the antibody drug-discovery market is likely to expand, catering to the needs of a diverse patient population.

Collaboration Among Research Institutions

Collaboration among research institutions and industry players is emerging as a vital driver for the antibody drug-discovery market. In the UK, partnerships between universities and pharmaceutical companies are fostering innovation and accelerating the development of new antibody therapies. These collaborations often lead to the sharing of resources, expertise, and technology, which can significantly enhance the drug discovery process. For instance, joint research initiatives have resulted in the identification of novel antibody targets and the development of cutting-edge therapeutic modalities. This collaborative approach is likely to strengthen the antibody drug-discovery market, as it facilitates the translation of scientific discoveries into viable treatment options for patients.

Advancements in Biomanufacturing Technologies

Innovations in biomanufacturing technologies are significantly impacting the antibody drug-discovery market. The UK has seen substantial investments in bioprocessing facilities, which are essential for the large-scale production of monoclonal antibodies. These advancements not only enhance the efficiency of production but also improve the quality and consistency of the final products. For instance, the adoption of single-use technologies and continuous manufacturing processes is streamlining operations and reducing costs. As a result, the antibody drug-discovery market is poised for growth, with an estimated market value reaching £5 billion by 2026. This trend indicates a robust pipeline of new therapies that could emerge from improved manufacturing capabilities.