Increasing Cancer Incidence

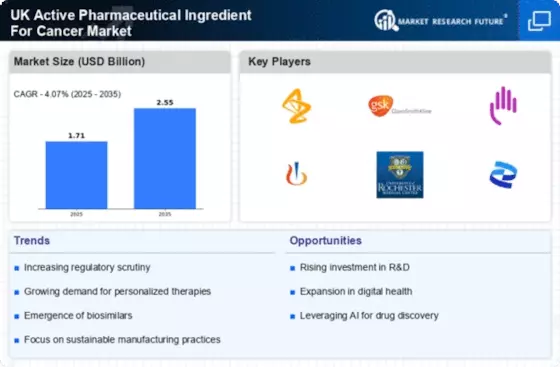

The UK Active Pharmaceutical Ingredient For Cancer Market is experiencing growth due to the rising incidence of cancer. According to the latest statistics, cancer cases in the UK are projected to increase by 12% by 2030. This surge in cancer prevalence necessitates the development and production of effective active pharmaceutical ingredients (APIs) to meet the growing demand for innovative therapies. The increasing burden of cancer on the healthcare system drives pharmaceutical companies to invest in research and development, thereby expanding the UK Active Pharmaceutical Ingredient For Cancer Market. Furthermore, the aging population in the UK, which is more susceptible to cancer, further exacerbates this trend, indicating a sustained need for advanced cancer treatments and their corresponding APIs.

Advancements in Biotechnology

Technological advancements in biotechnology are significantly influencing the UK Active Pharmaceutical Ingredient For Cancer Market. Innovations in biopharmaceuticals, including monoclonal antibodies and gene therapies, are reshaping cancer treatment paradigms. The UK is home to numerous biotech firms that are pioneering the development of novel APIs tailored for specific cancer types. For instance, the introduction of personalized medicine has led to the creation of targeted therapies that require specialized APIs. This trend is expected to continue, with the UK government supporting biotech initiatives through funding and favorable policies. As a result, the market for active pharmaceutical ingredients is likely to expand, driven by the need for cutting-edge cancer therapies.

Investment in Cancer Research

Investment in cancer research is a pivotal driver for the UK Active Pharmaceutical Ingredient For Cancer Market. The UK government, alongside private entities, has significantly increased funding for cancer research initiatives. In 2025, the total investment in cancer research reached approximately 1.5 billion GBP, reflecting a commitment to advancing treatment options. This influx of capital enables pharmaceutical companies to explore new APIs and develop innovative therapies that address unmet medical needs. Furthermore, collaborations between academic institutions and industry players are fostering the discovery of novel active pharmaceutical ingredients, thereby enhancing the overall landscape of cancer treatment in the UK.

Growing Demand for Generic Drugs

The growing demand for generic drugs is influencing the UK Active Pharmaceutical Ingredient For Cancer Market. As patents for several cancer medications expire, there is a notable shift towards the production of generic APIs, which are often more affordable and accessible to patients. This trend is particularly relevant in the UK, where healthcare costs are a significant concern. The National Health Service (NHS) actively promotes the use of generics to optimize healthcare spending, thereby driving the market for active pharmaceutical ingredients. Consequently, pharmaceutical companies are increasingly focusing on developing generic APIs for cancer treatments, which is expected to contribute to market growth in the coming years.

Regulatory Support and Frameworks

The regulatory environment in the UK plays a crucial role in shaping the Active Pharmaceutical Ingredient For Cancer Market. The Medicines and Healthcare products Regulatory Agency (MHRA) has established streamlined processes for the approval of cancer therapies, which encourages pharmaceutical companies to develop new APIs. Recent initiatives aimed at expediting the review of innovative cancer treatments have resulted in a more dynamic market landscape. Additionally, the UK government has implemented policies that promote collaboration between regulatory bodies and industry stakeholders, fostering an environment conducive to research and development. This supportive regulatory framework is likely to enhance the availability of effective APIs, ultimately benefiting patients and healthcare providers.