Market Analysis

In-depth Analysis of UAE Green Hydrogen Market Industry Landscape

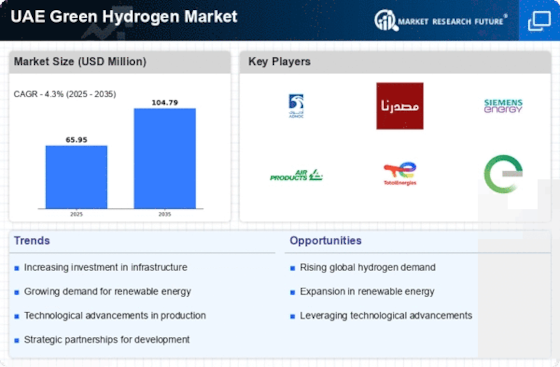

The UAE Green Hydrogen market is experiencing a significant shift in its dynamics, driven by the growing emphasis on sustainable energy sources and the global push towards decarbonization. Green hydrogen, produced through the electrolysis of water using renewable energy sources, has emerged as a key player in the transition towards cleaner energy in the United Arab Emirates. The market dynamics are shaped by a combination of factors, including government initiatives, technological advancements, and the increasing awareness of environmental sustainability.

Government initiatives play a pivotal role in shaping the UAE Green Hydrogen market. The UAE government has been actively promoting the development and adoption of green hydrogen as part of its broader strategy to diversify the energy mix and reduce carbon emissions. The ambitious targets set by the government, such as the commitment to achieving net-zero carbon emissions by 2050, provide a strong impetus for the growth of the green hydrogen sector. Subsidies, incentives, and regulatory frameworks are being put in place to encourage investments and foster a conducive environment for the development of green hydrogen projects.

Technological advancements also contribute significantly to the changing dynamics of the UAE Green Hydrogen market. Continuous research and innovation in electrolysis technologies, energy storage, and efficiency improvements are driving down the costs associated with green hydrogen production. As technology becomes more mature and economically viable, it enhances the competitiveness of green hydrogen against traditional forms of hydrogen production. This, in turn, attracts investments from both public and private sectors, fostering the growth of the green hydrogen market in the UAE.

The increasing awareness of environmental sustainability is another key driver shaping the market dynamics. Stakeholders across various industries, including energy, transportation, and manufacturing, are recognizing the importance of transitioning to cleaner and greener alternatives. Green hydrogen, being a versatile and clean energy carrier, is gaining traction as a viable solution to meet the increasing demand for sustainable energy. This awareness is prompting businesses to incorporate green hydrogen into their operations and supply chains, further fueling the demand for green hydrogen in the UAE market.

The UAE Green Hydrogen market is witnessing collaborations and partnerships between government bodies, private enterprises, and international players. These collaborations aim to leverage expertise, share resources, and accelerate the deployment of green hydrogen projects. International investments and collaborations bring in valuable experience and knowledge, facilitating the transfer of technology and best practices to the UAE. This collaborative approach not only contributes to the growth of the green hydrogen market but also positions the UAE as a key player in the global green hydrogen landscape.

Despite the positive momentum, challenges persist in the UAE Green Hydrogen market. One of the primary challenges is the initial high capital costs associated with setting up green hydrogen production facilities. However, as technology advances and economies of scale are achieved, these costs are expected to decrease, making green hydrogen more economically viable. Additionally, the intermittency of renewable energy sources poses a challenge to the consistent and reliable production of green hydrogen. Energy storage solutions and grid enhancements are being explored to address this issue and ensure a stable supply of green hydrogen.

The dynamics of the UAE Green Hydrogen market are undergoing a transformative shift, driven by government initiatives, technological advancements, and increasing environmental awareness. The collaborative efforts between stakeholders and international partnerships are contributing to the development and growth of the green hydrogen sector in the UAE. While challenges remain, the overall trajectory of the market indicates a promising future for green hydrogen as a key player in the country's sustainable energy landscape.

Leave a Comment