Top Industry Leaders in the UAE Green Hydrogen Market

*Disclaimer: List of key companies in no particular order

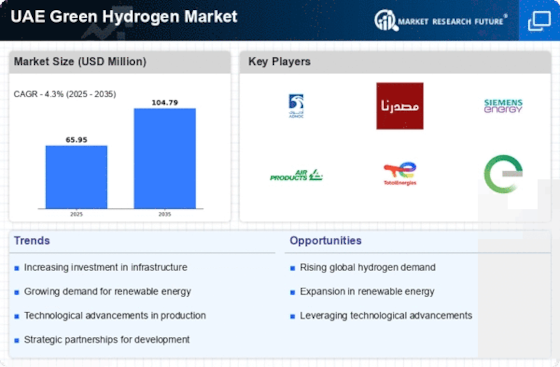

Top listed companies in the UAE Green Hydrogen industry are:

Air Products and Chemicals, Inc., Siemens Energy AG, Linde, Nel ASA, Wind to Gas Energy GmbH & Co. KG, H&R Olwerke Schindler GmbH, Guangdong Nation-Synergy Hydrogen Power Technologies Co., Ltd., Toshiba Energy Systems & Solutions Corporation, and Cummins Inc.

The UAE green hydrogen market stands poised for a meteoric rise, fueled by ambitious national decarbonization goals, abundant renewable resources, and strategic geographic positioning. This nascent landscape, however, is teeming with a diverse array of players, each vying for a slice of the pie. Understanding the current competitive scenario, key player strategies, and emerging trends is crucial for navigating this dynamic marketplace.

Market Shares: A Multitude of Players

As the market is in its early stages, establishing definitive market shares is challenging. Nonetheless, prominent players can be categorized into three groups:

1. Traditional Energy Giants: Oil and gas majors like ADNOC and Shell are leveraging their existing infrastructure and expertise to venture into green hydrogen production and downstream applications. ADNOC's green hydrogen project in Abu Dhabi, with an initial capacity of 200 MW, is a prime example.

2. Renewable Energy Developers: Companies like Masdar and ENWA are capitalizing on their renewable energy prowess to generate clean electricity for electrolyzers. Masdar's involvement in the 1GW H21 Green Hydrogen project in Sweihan highlights this trend.

3. International Technology Providers: Global players like Siemens Energy, Thyssenkrupp, and Nel Hydrogen are bringing their technological expertise in electrolyzer manufacturing and hydrogen storage solutions to the table. Siemens' partnership with DEWA for a 44 MW electrolyzer project exemplifies this collaboration.

Factors Shaping Market Shares:

Analyzing market share in the UAE green hydrogen market requires consideration of several key factors:

• Project Pipeline: Companies with secured projects and early mover advantage will have a clear head start. ADNOC's pipeline of several large-scale projects gives them a significant edge.

• Technological Innovation: Developing cost-effective and efficient electrolyzer technologies will be critical for cost competitiveness. Companies like Thyssenkrupp, with their alkaline electrolyzer advancements, are well-positioned.

• Downstream Partnerships: Securing partnerships with end-users in industry, transportation, and power generation will be crucial for offtake and market development. ENWA's collaborations with DEWA and Emirates NBD in hydrogen mobility projects demonstrate this approach.

• Government Support: Access to government grants, subsidies, and regulatory incentives will play a significant role in shaping project feasibility and attracting investment. Masdar's involvement in projects benefiting from UAE's hydrogen strategy underlines this factor.

New and Emerging Trends:

Beyond the established players, several trends are shaping the competitive landscape:

• Consolidation: Mergers and acquisitions are expected as companies seek to diversify and expand their capabilities. Recent examples include ENWA's acquisition of a hydrogen refueling station operator.

• Local Manufacturing: Building a domestic electrolyzer and equipment manufacturing base is gaining traction, with initiatives like the DEWA-Siemens joint venture project aiming for local production.

• Regional Collaboration: The GCC as a whole is seen as a promising hydrogen hub, with collaborative projects like the Oman-UAE hydrogen pipeline envisioned for cross-border trade and knowledge sharing.

• Green Ammonia Adoption: Ammonia produced using green hydrogen, offering easier storage and transportation, is gaining interest, with ADNOC and others exploring its potential.

Competitive Scenario: A Dynamic Playing Field

The UAE green hydrogen market is characterized by intense competition, with established players jostling for position alongside innovative newcomers. While oil and gas majors leverage their existing infrastructure, renewable energy developers and international technology providers are bringing their niche expertise to the table. Analyzing market share through the lens of project pipeline, technological innovation, downstream partnerships, and government support will be crucial for understanding the competitive dynamics. New trends like consolidation, local manufacturing, regional collaboration, and green ammonia adoption further add complexity to the landscape. Ultimately, companies that adapt to the rapidly evolving environment, forge strategic partnerships, and maintain focus on cost-effective solutions will stand to gain the most as the UAE green hydrogen market takes off.

Latest Company Updates:

Air Products and Chemicals, Inc.

• January 2024: Partnered with DEWA (Dubai Electricity and Water Authority) to explore green hydrogen production opportunities in Dubai.

Siemens Energy AG

• October 2023: Successfully commissioned the first phase of Dubai's green hydrogen project at Expo 2020 site, producing 100 kg of green hydrogen daily.

Nel ASA

• December 2023: Delivered a 20 MW alkaline electrolyzer to a green hydrogen project in Dubai.

Cummins Inc.

• October 2023: Announced plans to supply electrolyzers and fuel cell technology for a green hydrogen project in Sharjah, UAE.