Top Industry Leaders in the Turboexpander Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

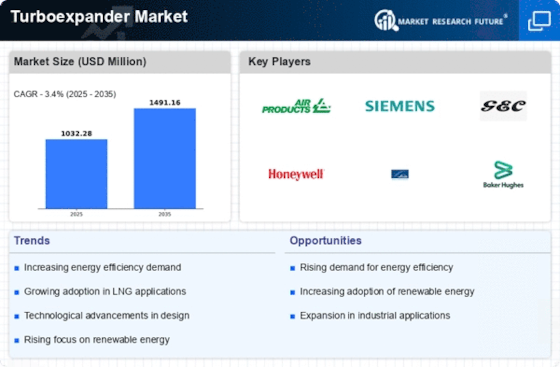

The global turboexpander market is expected to reach a value of USD 1.29 billion by 2028, growing at a CAGR of 4.60% during the forecast period (2023-2028). The market is driven by the increasing demand for energy-efficient production of natural gas, as well as the growing adoption of natural gas for power generation and fuel for various industries.

Key Player Strategies

The major players in the turboexpander market are adopting various strategies to gain market share and maintain their competitive edge. These strategies include:

Product innovation: Leading players are investing in research and development to develop new and improved turboexpander designs that are more efficient, reliable, and cost-effective.

Geographic expansion: Players are expanding their operations into new geographic markets, particularly in Asia-Pacific, which is expected to be the fastest-growing region for the turboexpander market.

Acquisitions and partnerships: Some players are acquiring smaller companies or partnering with other companies to expand their product offerings and reach new customer segments.

Focus on customer service: Players are focusing on providing excellent customer service to retain existing customers and attract new ones.

Factors for Market Share Analysis

The key factors that will determine market share in the turboexpander market include:

Company size and financial strength: Larger, more financially stable companies are better positioned to compete in the market.

Brand reputation: Companies with a strong brand reputation are more likely to be able to command premium prices for their products.

Technological expertise: Companies with a strong technological expertise are better positioned to develop new and improved products.

Distribution network: Companies with a strong distribution network are better positioned to reach a wider range of customers.

Customer service: Companies that provide excellent customer service are more likely to retain existing customers and attract new ones.

New and Emerging Trends

Some of the new and emerging trends in the turboexpander market include:

The increasing demand for smaller and more portable turboexpanders: This trend is being driven by the growing demand for natural gas in remote locations, such as offshore oil and gas rigs.

The development of new materials and technologies: New materials and technologies are being developed that can make turboexpanders more efficient, reliable, and cost-effective.

The increasing focus on energy efficiency: The rising cost of energy is driving the demand for more energy-efficient turboexpanders.

The growing adoption of renewable energy sources: The increasing adoption of renewable energy sources, such as solar and wind power, is creating new opportunities for turboexpanders in energy storage applications.

Overall Competitive Scenario

The turboexpander market is a fragmented market with a large number of players. However, the market is dominated by a few large players, such as Baker Hughes, GE Oil & Gas, and MAN Turbo. These players are well-positioned to compete in the market due to their strong brand reputations, financial strength, and technological expertise. The competitive landscape of the turboexpander market is expected to remain intense in the coming years, as players vie for market share.

The turboexpander market is a growing market with a promising future. The increasing demand for energy-efficient production of natural gas, as well as the growing adoption of natural gas for power generation and fuel for various industries, is driving the growth of the market. The competitive landscape of the market is intense, but the players that are able to innovate, expand geographically, and provide excellent customer service are well-positioned to succeed.

Atlas Copco (Sweden):

Dec 2023: Announced partnership with China Huaqi Gas Group to supply oil-free centrifugal compressors and expanders for LNG projects in China. (Source: Atlas Copco Press Release)

Nov 2023: Unveiled new GA/GMV oil-free screw compressors and expanders with focus on energy efficiency and reduced environmental impact. (Source: Atlas Copco Website)

Baker Hughes a GE company (US):

Oct 2023: Launched NOVEX NXL turboexpander series for improved efficiency and reliability in natural gas processing applications. (Source: Baker Hughes Press Release)

Sept 2023: Secured significant contract from a major LNG exporter for delivery of NOVEX turboexpanders and cryogenic pumps. (Source: Baker Hughes Website)

Cyrostar (France):

Dec 2023: Showcased new CRYostar CTT2 oil-free turboexpander for challenging air separation applications at K-2023 trade show. (Source: Cyrostar Press Release)

Nov 2023: Successfully commissioned two CRYostar CLA expanders for an industrial gas plant in Asia, achieving record low operating temperatures. (Source: Cyrostar Website)

Air Products & Chemicals.Inc (US):

Oct 2023: Acquired Cryogenic Industries, a leading manufacturer of small to medium cryogenic expanders, expanding its product portfolio. (Source: Air Products Press Release)

Sept 2023: Announced development of next-generation high-efficiency turboexpanders for hydrogen liquefaction applications. (Source: Air Products Website)

Top listed global companies in the industry are:

Atlas Corpo (Sweden), Baker Huges a GE company (US), Cyrostar (France), Air Products & Chemicals.Inc (US), L.A. Turbine (US), Honeywell (US), Man Energy Solutions (Germany), Siemens (Germany), ACD LLC (Switzerland), Elliot Group (US), R&D Dynamics Corporation (US), Turbogaz (Ukraine)