Regulatory Support

Government regulations play a crucial role in shaping the Global Truck Platooning Market Industry. Many countries are implementing policies that promote the adoption of automated driving technologies, including truck platooning. For example, the European Union has established frameworks to facilitate testing and deployment of connected and automated vehicles. Such regulatory support not only enhances safety standards but also encourages investment in infrastructure that supports platooning. As regulations become more favorable, the market is likely to see increased participation from various stakeholders, further driving growth and innovation in the sector.

Economic Efficiency

Economic efficiency remains a pivotal driver in the Global Truck Platooning Market Industry. By enabling trucks to travel closely together, platooning reduces air drag and fuel consumption, leading to substantial cost savings for logistics companies. Fleet operators are increasingly recognizing the financial benefits associated with reduced fuel expenses and improved delivery times. The potential for lower operational costs is particularly appealing in a competitive market where margins are often tight. As the industry continues to evolve, the economic advantages of truck platooning are likely to become more pronounced, further encouraging its adoption across various regions.

Environmental Concerns

Growing environmental concerns are increasingly influencing the Global Truck Platooning Market Industry. The transportation sector is a significant contributor to greenhouse gas emissions, prompting governments and organizations to seek sustainable solutions. Truck platooning, which can reduce fuel consumption and emissions through optimized driving patterns, presents a viable option. Studies indicate that platooning can lead to fuel savings of up to 10-15%, making it an attractive choice for fleet operators aiming to meet sustainability targets. As environmental regulations tighten, the adoption of truck platooning is expected to accelerate, aligning with global efforts to combat climate change.

Market Growth Projections

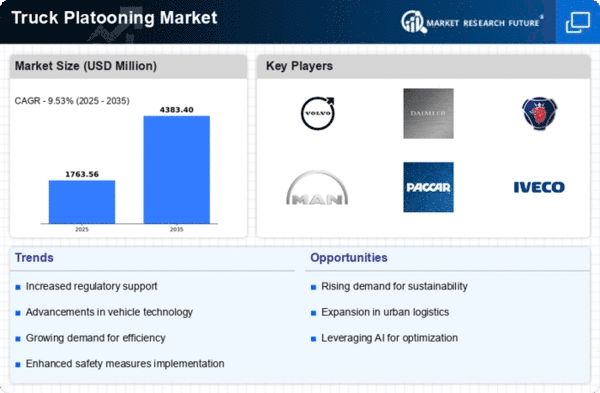

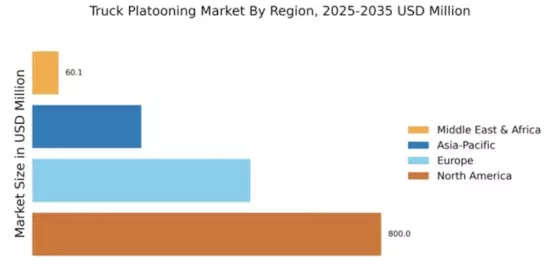

The Global Truck Platooning Market Industry is poised for substantial growth, with projections indicating a rise from 1.61 USD Billion in 2024 to 4.38 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 9.53% from 2025 to 2035. Such figures highlight the increasing recognition of the benefits associated with truck platooning, including enhanced safety, reduced operational costs, and improved fuel efficiency. As more stakeholders enter the market and technological advancements continue to unfold, the industry is likely to experience dynamic changes that will shape its future.

Infrastructure Development

Infrastructure development is a key factor influencing the Global Truck Platooning Market Industry. The successful implementation of truck platooning requires robust road networks equipped with advanced communication systems. Governments and private entities are investing in smart infrastructure that supports vehicle connectivity and automation. For instance, dedicated lanes for platooning trucks and enhanced traffic management systems can facilitate smoother operations. As infrastructure improves, the practicality and efficiency of truck platooning are expected to increase, thereby attracting more participants to the market. This trend is likely to bolster the overall growth of the industry in the coming years.

Technological Advancements

The Global Truck Platooning Market Industry is significantly driven by rapid technological advancements in automation and connectivity. Innovations in vehicle-to-vehicle communication and advanced driver-assistance systems are enhancing the feasibility of platooning. For instance, the integration of sensors and artificial intelligence enables trucks to communicate in real-time, optimizing fuel efficiency and safety. As these technologies mature, they are expected to reduce operational costs for fleet operators, thereby increasing adoption rates. The market is projected to grow from 1.61 USD Billion in 2024 to 4.38 USD Billion by 2035, reflecting a compound annual growth rate of 9.53% from 2025 to 2035.