Market Trends

Key Emerging Trends in the Transient Ischemic Attack Market

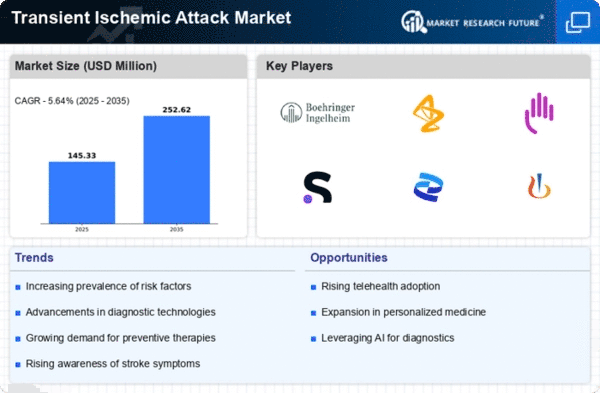

The transient ischemic attack (TIA) market is undergoing significant changes due to various factors impacting diagnosis, treatment, and prevention of this condition. One of the prominent trends in the TIA market is the increasing awareness and recognition of TIAs among healthcare professionals and the general population. As awareness campaigns and educational initiatives raise understanding about TIAs and their potential consequences, more individuals are seeking medical attention for symptoms suggestive of TIA, leading to earlier diagnosis and intervention.

Furthermore, advancements in medical technology and diagnostic tools are reshaping the landscape of TIA diagnosis and management. Improved imaging techniques such as magnetic resonance imaging (MRI) and computed tomography (CT) scans enable healthcare providers to accurately identify TIAs and distinguish them from other conditions with similar symptoms. Additionally, the development of point-of-care diagnostic tests allows for rapid assessment of patients suspected of experiencing a TIA, facilitating timely decision-making regarding treatment and management.

Another significant trend in the TIA market is the emphasis on secondary prevention strategies to reduce the risk of recurrent strokes or TIAs. As healthcare providers recognize the high risk of subsequent cerebrovascular events following a TIA, there is increasing focus on aggressive management of modifiable risk factors such as hypertension, diabetes, hyperlipidemia, and atrial fibrillation. This includes the widespread use of antithrombotic medications, statins, antihypertensive drugs, and lifestyle modifications to prevent further episodes and improve long-term outcomes for patients with TIAs.

Moreover, the TIA market is witnessing a shift towards personalized medicine approaches tailored to individual patient characteristics and risk profiles. With advances in genetics and molecular biology, researchers are exploring biomarkers and genetic markers associated with an increased risk of TIAs and stroke. This allows for more targeted interventions and precision medicine strategies aimed at optimizing treatment efficacy and minimizing adverse effects. Additionally, the integration of artificial intelligence and machine learning algorithms into clinical decision-making processes holds promise for identifying high-risk individuals and predicting outcomes following a TIA.

Furthermore, telemedicine and remote monitoring technologies are playing an increasingly important role in the management of patients with TIAs, particularly in the post-acute phase. Telehealth platforms enable healthcare providers to conduct virtual consultations, monitor patients' symptoms remotely, and adjust treatment plans as needed. This not only enhances access to care, especially for individuals in rural or underserved areas but also facilitates ongoing communication between patients and healthcare providers, leading to improved adherence to treatment regimens and better outcomes.

Additionally, regulatory changes and healthcare policies are influencing the TIA market, particularly in terms of reimbursement policies and guidelines for stroke prevention and management. As healthcare systems strive to optimize resource utilization and improve quality of care, there is growing emphasis on evidence-based practices and adherence to clinical guidelines for the management of TIAs. This includes initiatives to standardize care protocols, enhance interdisciplinary collaboration among healthcare providers, and implement quality improvement measures to ensure consistent and effective management of TIAs across different healthcare settings.

Leave a Comment