Transfer Switch Size

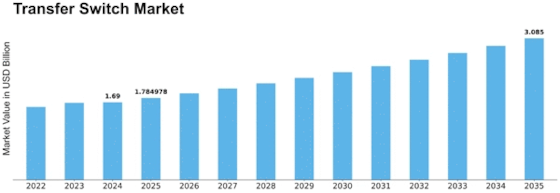

Transfer Switch Market Growth Projections and Opportunities

The Transfer Switch market is a crucial component within the broader landscape of electrical power systems. Its dynamics are shaped by a combination of factors that influence both supply and demand. As societies continue to evolve and industries expand, the need for reliable and efficient power transfer becomes increasingly significant. This has led to a growing demand for transfer switches, devices designed to seamlessly shift electrical loads between power sources. The market dynamics of the transfer switch industry are multifaceted, encompassing technological advancements, regulatory changes, and economic considerations.

Technological innovation is a driving force in the transfer switch market. As new technologies emerge, transfer switch manufacturers strive to integrate them into their products to enhance performance, reliability, and efficiency. The advent of smart transfer switches, capable of remote monitoring and control, has gained traction in recent years. These advancements not only cater to the demand for more sophisticated solutions but also contribute to the overall growth and competitiveness of the market.

Regulatory changes play a pivotal role in shaping the transfer switch market. Governments and regulatory bodies often introduce standards and guidelines to ensure the safety and reliability of electrical systems. Compliance with these regulations becomes a key factor for manufacturers, influencing product design and features. The push towards sustainable and energy-efficient solutions has also impacted the transfer switch market, with a growing emphasis on environmentally friendly designs and practices.

Economic factors significantly impact the dynamics of the transfer switch market. The level of industrialization, infrastructure development, and economic growth in different regions directly influences the demand for transfer switches. In rapidly developing economies, the need for reliable power supply in both urban and rural areas fuels market growth. Additionally, economic downturns or uncertainties may lead to fluctuations in demand as businesses and industries reassess their capital expenditures.

The market dynamics are further influenced by the diverse applications of transfer switches across various sectors. The residential sector, for example, utilizes transfer switches for backup power during outages, ensuring continuous electricity supply to essential appliances. In commercial and industrial settings, transfer switches are integral to emergency power systems, data centers, and critical infrastructure where uninterrupted power is non-negotiable. Understanding and catering to the specific needs of these sectors are crucial for manufacturers to stay competitive in the market.

Global trends also impact the transfer switch market dynamics. The increasing awareness of the importance of reliable power supply, coupled with the rising frequency of natural disasters, has heightened the demand for transfer switches worldwide. Regions prone to hurricanes, earthquakes, or other natural disasters show a particularly high demand for robust transfer switch solutions to ensure quick and efficient power transfers during emergencies.

In conclusion, the transfer switch market is characterized by a dynamic interplay of technological innovation, regulatory changes, economic factors, and global trends. Manufacturers in this industry must continually adapt to stay ahead in a competitive landscape where reliability, efficiency, and compliance with standards are paramount. As societies continue to evolve and embrace new technologies, the transfer switch market is likely to witness further developments, making it an intriguing sector to watch in the broader context of electrical power systems.

Leave a Comment