Transfer Case Market Summary

As per Market Research Future analysis, the Transfer Case Market Size was estimated at 16833.87 USD Million in 2024. The Transfer Case industry is projected to grow from 18431.4 USD Million in 2025 to 45635.52 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 9.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Transfer Case Market is experiencing a dynamic evolution driven by technological advancements and changing consumer preferences.

- The market is witnessing a shift towards lightweight materials to enhance vehicle efficiency and performance.

- Integration of smart technologies is becoming prevalent, enabling improved functionality and user experience in transfer case systems.

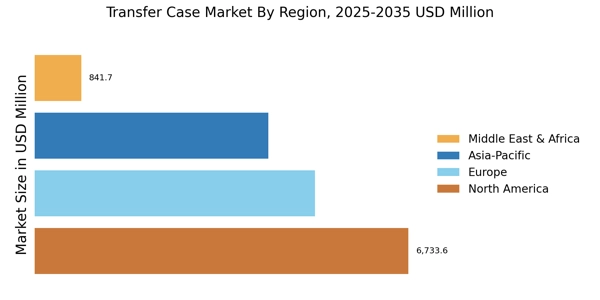

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region, reflecting diverse consumer demands.

- Rising demand for all-wheel drive vehicles and technological advancements in transfer case systems are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 16833.87 (USD Million) |

| 2035 Market Size | 45635.52 (USD Million) |

| CAGR (2025 - 2035) | 9.49% |

Major Players

GKN Automotive (GB), Magna International (CA), Dana Incorporated (US), Aisin Seiki Co., Ltd. (JP), ZF Friedrichshafen AG (DE), BorgWarner Inc. (US), American Axle & Manufacturing (US), JTEKT Corporation (JP)