Market Trends

Key Emerging Trends in the Trade Surveillance Systems Market

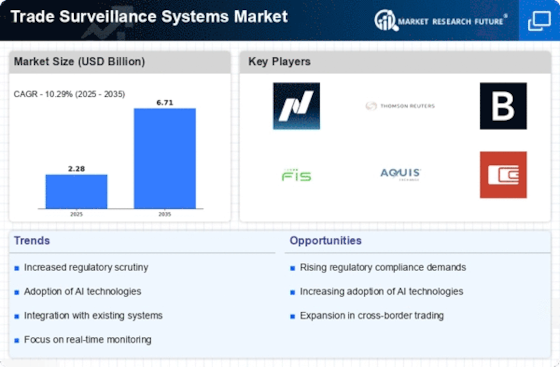

The trade surveillance systems market is witnessing dynamic trends driven by the evolving landscape of financial markets, technological advancements, and regulatory developments. One prominent trend is the increasing adoption of artificial intelligence (AI) and machine learning (ML) in trade surveillance. AI-powered systems can analyze vast amounts of trading data, identify complex patterns, and adapt to evolving market conditions. This trend reflects the industry's recognition of the need for more sophisticated surveillance capabilities to detect market abuses and compliance breaches in real-time. The integration of advanced analytics and predictive modeling enhances the efficiency and effectiveness of trade surveillance, enabling financial institutions to stay ahead of emerging risks and regulatory challenges.

Regulatory technology, or RegTech, is a prevailing trend in the trade surveillance systems market. The regulatory landscape is becoming more complex, with stringent requirements imposed by financial authorities worldwide. RegTech solutions, including trade surveillance systems, leverage technology to automate compliance processes, streamline reporting, and enhance risk management. This trend signifies the industry's proactive approach to meeting regulatory obligations efficiently, reducing compliance costs, and ensuring adherence to evolving compliance standards.

Cloud-based trade surveillance solutions are gaining prominence as a key trend in the market. Financial institutions are increasingly adopting cloud-based systems for trade surveillance due to their scalability, flexibility, and cost-effectiveness. Cloud solutions offer the ability to handle large volumes of data, facilitate remote access, and provide a more agile response to changing market conditions. This trend aligns with the broader industry shift toward cloud-based technologies, reflecting the desire for efficient and adaptable surveillance solutions in the digital era.

The rise of alternative data sources is influencing the dynamics of trade surveillance systems. Traditionally, surveillance systems relied on structured financial data, but the inclusion of alternative data, such as social media sentiment, news analytics, and satellite imagery, is becoming more prevalent. This trend reflects the industry's recognition of the value in harnessing diverse datasets to gain comprehensive insights into market activities and potential risks. The integration of alternative data enhances the predictive capabilities of trade surveillance systems, allowing for a more nuanced understanding of market dynamics.

Machine-readable regulations and natural language processing (NLP) are emerging as notable trends in the trade surveillance systems market. Machine-readable regulations enable automated interpretation of complex regulatory texts, facilitating quicker updates to surveillance systems in response to regulatory changes. NLP, on the other hand, enables systems to understand and analyze unstructured data, such as news articles and social media content, to assess their impact on market activities. These trends reflect the industry's efforts to enhance the agility and responsiveness of surveillance systems in the face of evolving regulatory requirements and market dynamics.

Cross-asset surveillance is gaining traction as a trend in response to the increasing convergence of various financial instruments and markets. Traditional asset classes are becoming more interconnected, requiring surveillance systems to monitor a broader range of activities across different asset types. This trend reflects the industry's recognition of the need for holistic surveillance solutions that can provide a unified view of trading activities and potential risks across the entire market landscape.

The emphasis on explainability and interpretability in AI-driven trade surveillance is another significant trend. As AI algorithms play a crucial role in decision-making, there is a growing focus on making these algorithms more transparent and understandable. Explainable AI (XAI) ensures that surveillance systems provide clear insights into how they arrive at specific conclusions, addressing concerns related to the opacity of AI systems. This trend aligns with the industry's commitment to fostering trust and accountability in the use of AI technologies for trade surveillance.

Leave a Comment