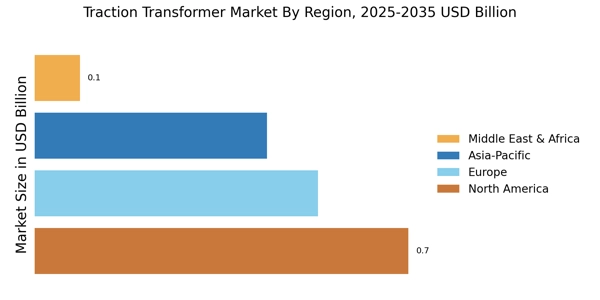

Sustainability Initiatives

Sustainability initiatives are becoming increasingly influential in shaping the Traction Transformer Market. Governments and organizations are prioritizing eco-friendly solutions to combat climate change, leading to a surge in demand for energy-efficient traction transformers. These transformers are designed to minimize energy losses and reduce greenhouse gas emissions, aligning with global sustainability targets. Recent studies suggest that the market for energy-efficient transformers is expected to grow by 15% annually, driven by regulatory frameworks and incentives for green technologies. As rail operators seek to enhance their sustainability profiles, the adoption of advanced traction transformers becomes essential. This trend not only supports environmental goals but also enhances the overall efficiency of rail operations, thereby propelling the Traction Transformer Market.

Technological Advancements

Technological advancements in traction transformer design and manufacturing are reshaping the Traction Transformer Market. Innovations such as improved insulation materials, enhanced cooling systems, and smart monitoring technologies are leading to more efficient and reliable transformers. These advancements not only increase the lifespan of transformers but also reduce maintenance costs, which is appealing to operators. The integration of digital technologies allows for real-time monitoring and predictive maintenance, thereby minimizing downtime. Market data indicates that the adoption of smart transformers is expected to grow at a compound annual growth rate of 8% over the next five years. This technological evolution is crucial for meeting the increasing demands of modern rail systems, thus driving the growth of the Traction Transformer Market.

Electrification of Rail Networks

The ongoing electrification of rail networks is a pivotal driver for the Traction Transformer Market. As countries invest in modernizing their rail infrastructure, the demand for efficient and reliable traction transformers increases. This shift towards electrification is not merely a trend; it is a necessity for enhancing operational efficiency and reducing carbon emissions. According to recent data, the electrification rate of railways is projected to reach 70% by 2030, which will significantly boost the traction transformer market. The transition from diesel to electric trains necessitates advanced traction transformers that can handle higher voltages and provide stable power supply, thereby propelling the market forward. Furthermore, this trend aligns with global sustainability goals, making it a critical factor in the growth of the Traction Transformer Market.

Urbanization and Population Growth

Urbanization and population growth are significant factors influencing the Traction Transformer Market. As urban areas expand, the demand for efficient public transportation systems, including rail networks, increases. This growth necessitates the deployment of advanced traction transformers to support the electrification of urban rail systems. Data indicates that urban populations are expected to rise by 2.5 billion by 2050, leading to a substantial increase in rail transit needs. Consequently, the demand for traction transformers that can provide reliable power to urban rail systems is likely to surge. This trend underscores the importance of investing in robust traction transformer solutions to accommodate the growing urban transit demands, thereby driving the Traction Transformer Market.

Government Investments in Rail Infrastructure

Government investments in rail infrastructure are a crucial driver for the Traction Transformer Market. Many countries are recognizing the importance of rail transport in reducing traffic congestion and lowering carbon emissions. As a result, substantial funding is being allocated to upgrade and expand rail networks, which includes the installation of modern traction transformers. Recent reports indicate that rail infrastructure investments are projected to exceed 200 billion dollars over the next decade. This influx of capital is expected to enhance the reliability and efficiency of rail systems, thereby increasing the demand for advanced traction transformers. Such investments not only improve transportation efficiency but also stimulate economic growth, making them a vital component of the Traction Transformer Market.