Urbanization Trends

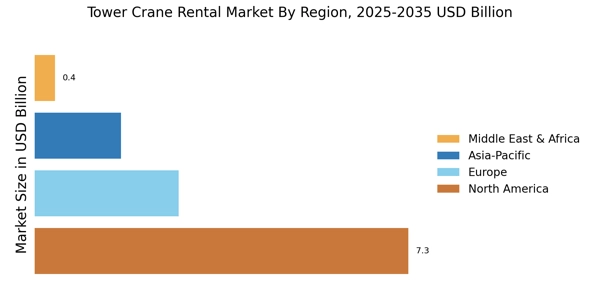

The rapid pace of urbanization is significantly impacting the Tower Crane Rental Market. As populations migrate to urban areas, the demand for housing, commercial spaces, and infrastructure increases. This urban growth necessitates extensive construction activities, which in turn drives the need for tower cranes. Recent statistics suggest that urban areas are expected to house nearly 70% of the global population by 2050, leading to an unprecedented demand for construction services. Consequently, rental companies are likely to experience heightened demand for tower cranes to support these urban development projects. The Tower Crane Rental Market is thus well-positioned to capitalize on the ongoing urbanization trends.

Infrastructure Development

The ongoing expansion of infrastructure projects appears to be a primary driver for the Tower Crane Rental Market. Governments and private entities are investing heavily in urban development, transportation networks, and commercial buildings. For instance, the construction sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth necessitates the use of tower cranes, which are essential for lifting heavy materials and facilitating construction processes. As a result, the demand for tower crane rentals is likely to increase, providing rental companies with opportunities to expand their fleets and services. The Tower Crane Rental Market is thus positioned to benefit from this trend, as more projects require efficient and reliable lifting solutions.

Technological Advancements

Technological advancements in crane design and operation are influencing the Tower Crane Rental Market positively. Innovations such as remote control operation, enhanced safety features, and improved load capacity are making tower cranes more efficient and safer to use. These advancements not only increase productivity on construction sites but also reduce operational costs for rental companies. The integration of smart technologies, such as IoT and AI, is also enhancing the management and monitoring of crane operations. As these technologies become more prevalent, the demand for technologically advanced tower cranes is likely to rise, prompting rental companies to upgrade their fleets. This trend indicates a shift towards more sophisticated equipment in the Tower Crane Rental Market.

Rising Construction Activities

The resurgence of construction activities across various sectors is driving the Tower Crane Rental Market. With a notable increase in residential, commercial, and industrial projects, the demand for tower cranes is expected to rise significantly. Recent data indicates that construction spending has increased by approximately 6% year-on-year, reflecting a robust recovery in the sector. This uptick in construction activities necessitates the use of tower cranes for efficient material handling and project execution. Consequently, rental companies are likely to see a surge in demand for their services, as contractors prefer renting over purchasing due to cost-effectiveness and flexibility. The Tower Crane Rental Market is thus poised for growth as construction activities continue to expand.

Cost Efficiency and Flexibility

The emphasis on cost efficiency and flexibility in construction projects is shaping the Tower Crane Rental Market. Many contractors prefer renting equipment rather than purchasing it outright, as this approach allows for better allocation of resources and reduced capital expenditure. The rental model provides flexibility to scale operations according to project requirements, which is particularly advantageous in a fluctuating market. Additionally, rental companies often offer maintenance and support services, further enhancing the appeal of renting over buying. This trend is likely to continue, as more construction firms recognize the financial benefits of utilizing rental services. The Tower Crane Rental Market is thus expected to thrive as the demand for cost-effective and flexible solutions grows.