Increased Focus on Sustainability

Sustainability initiatives are becoming increasingly important within the Top Coated Direct Thermal Printing Film Market. As consumers and businesses alike prioritize eco-friendly practices, manufacturers are responding by developing sustainable printing solutions. This includes the use of recyclable materials and environmentally friendly inks, which align with global sustainability goals. The market is witnessing a shift towards products that minimize environmental impact, with a growing number of companies committing to sustainable sourcing and production methods. This trend not only enhances brand reputation but also meets regulatory requirements, further driving the growth of the Top Coated Direct Thermal Printing Film Market. As sustainability becomes a core value for many organizations, the demand for eco-conscious printing solutions is likely to rise.

Advancements in Printing Technology

Technological advancements play a pivotal role in shaping the Top Coated Direct Thermal Printing Film Market. Innovations in printing technology, such as improved thermal transfer capabilities and enhanced print quality, are driving the adoption of top coated films. These advancements enable businesses to produce high-resolution images and barcodes, which are essential for effective product identification and tracking. The market is witnessing a shift towards more sophisticated printing solutions, with manufacturers investing in research and development to enhance product offerings. As a result, the Top Coated Direct Thermal Printing Film Market is expected to expand, catering to the evolving needs of various sectors, including food and beverage, pharmaceuticals, and logistics.

Expansion of E-commerce and Retail Sectors

The expansion of e-commerce and retail sectors significantly influences the Top Coated Direct Thermal Printing Film Market. With the rise of online shopping, there is an increasing need for efficient labeling solutions to manage inventory and streamline shipping processes. Direct thermal printing offers a practical solution for e-commerce businesses, allowing for quick and accurate label production. The market is projected to see a substantial increase in demand as retailers and logistics companies seek to enhance their operational efficiency. This trend is likely to continue, with the Top Coated Direct Thermal Printing Film Market poised to capitalize on the growth of e-commerce and retail, providing essential labeling solutions that meet the needs of a rapidly evolving market.

Customization and Versatility in Applications

The Top Coated Direct Thermal Printing Film Market is characterized by a growing demand for customization and versatility in applications. Businesses are increasingly seeking tailored solutions that meet specific labeling requirements, whether for product packaging, shipping labels, or promotional materials. This trend is particularly evident in sectors such as retail and logistics, where unique branding and product differentiation are essential. The ability to customize prints not only enhances the visual appeal of products but also improves functionality. As a result, manufacturers in the Top Coated Direct Thermal Printing Film Market are focusing on offering a diverse range of products that cater to various customer needs, thereby driving market growth.

Rising Demand for Efficient Labeling Solutions

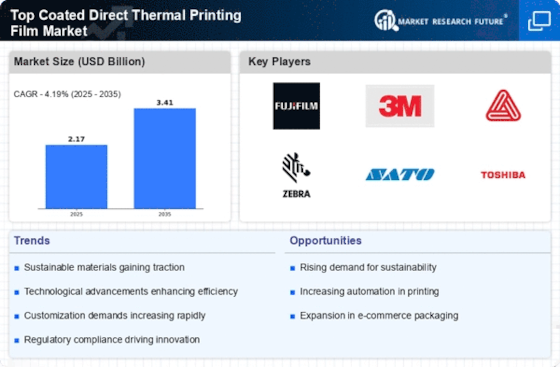

The Top Coated Direct Thermal Printing Film Market experiences a notable surge in demand for efficient labeling solutions across various sectors. Industries such as retail, logistics, and healthcare increasingly rely on direct thermal printing for their labeling needs due to its cost-effectiveness and speed. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years, driven by the need for quick and reliable labeling solutions. This trend is particularly evident in the e-commerce sector, where timely and accurate labeling is crucial for operational efficiency. As businesses seek to streamline their processes, the Top Coated Direct Thermal Printing Film Market is likely to benefit from this growing demand, positioning itself as a key player in the labeling solutions landscape.

Leave a Comment