Market Analysis

In-depth Analysis of Tobacco Packaging Market Industry Landscape

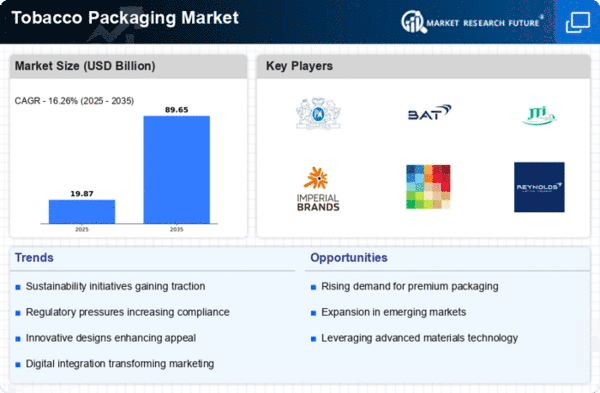

Complex interactions of components affect tobacco package market dynamics, reflecting shifting consumer preferences and regulatory contexts. Packaging material and design innovation drive this market. Consumer awareness of packaging's environmental impact boosts demand for eco friendly alternatives. The tobacco industry uses biodegradable materials and reduces packaging.

Globally severe government regulations alter market dynamics. The government regulates tobacco packaging to discourage smoking and enhance public health. Warning labels, graphic artwork, and plain package constraints influence tobacco product branding and packaging.

Global economic conditions and consumer buying patterns affect tobacco packaging. Economic downturns reduce disposable income, consumer purchasing power, and premium packaging demand. Developing economies may create new business opportunities as middle-class customers demand tobacco products with sophisticated packaging.

Additionally, technology drives tobacco packaging business dynamics. Smart packaging is growing, improving product safety, traceability, and user engagement. To comply with regulations and educate consumers, RFID tags, QR codes, and interactive packaging are being tested.

Manufacturers' branding and differentiation activities affect tobacco packaging market dynamics. Packaging design, color, and materials are chosen to attract the target audience. Packaging is crucial for enterprises to communicate brand values and connect with customers since brand loyalty influences consumer choices.

Global trends like e-cigarettes and smokeless tobacco affect tobacco packaging. Packaging for alternative tobacco products must meet their needs. Manufacturers are investigating container designs that emphasize these options' decreased danger for health-conscious consumers.

Campaigns against smoking, health awareness, and tobacco substitutes threaten the tobacco packaging market. Packaging companies can adjust to shifting consumer tastes and social conventions due to these issues.

Leave a Comment