Regulatory Changes

Regulatory changes are playing a critical role in shaping the Title Insurance Market. Governments are continuously updating laws and regulations related to property transactions, which can impact the requirements for title insurance. In 2025, it is anticipated that new regulations will be introduced to enhance consumer protection and transparency in real estate transactions. These changes may require title insurance companies to adapt their policies and practices, potentially leading to increased demand for their services. As the regulatory landscape evolves, title insurance providers must remain agile to comply with new requirements, making regulatory changes a significant driver of the Title Insurance Market.

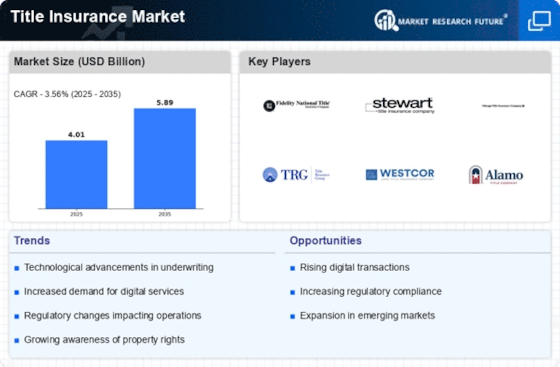

Technological Advancements

Technological advancements are reshaping the Title Insurance Market, enhancing efficiency and accuracy in title searches and transactions. The integration of artificial intelligence and blockchain technology is streamlining processes, reducing the time required for title searches and improving data security. In 2025, it is estimated that over 30% of title insurance companies will adopt advanced technologies to optimize their operations. This shift not only lowers operational costs but also enhances customer satisfaction by providing faster service. As technology continues to evolve, it appears that the Title Insurance Market will increasingly rely on these innovations to meet the demands of a modern clientele.

Economic Growth and Stability

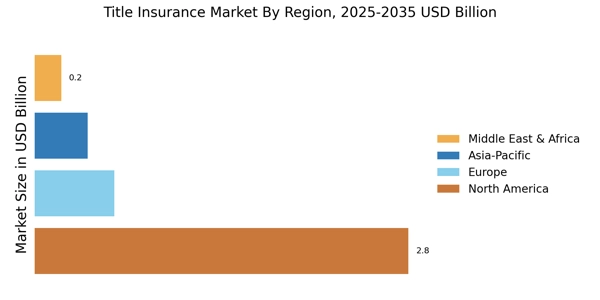

Economic growth and stability are fundamental drivers of the Title Insurance Market. As economies strengthen, consumer confidence typically rises, leading to increased investments in real estate. In 2025, economic indicators suggest a positive outlook, with GDP growth projected at around 3% in many regions. This economic stability encourages individuals and businesses to engage in property transactions, thereby boosting the demand for title insurance. Furthermore, a robust economy often correlates with higher property values, which can increase the premiums associated with title insurance policies. Thus, economic growth and stability are likely to remain pivotal factors influencing the Title Insurance Market.

Rising Real Estate Transactions

The Title Insurance Market is experiencing a surge in real estate transactions, driven by increasing property sales and purchases. As more individuals and businesses engage in real estate activities, the demand for title insurance is likely to rise. In 2025, the number of residential and commercial property transactions is projected to increase by approximately 5% compared to previous years. This uptick in transactions necessitates the protection that title insurance provides, ensuring that buyers are safeguarded against potential claims or disputes regarding property ownership. Consequently, the growth in real estate transactions is a pivotal driver for the Title Insurance Market, as it directly correlates with the need for title insurance services.

Increased Awareness of Title Insurance

There is a growing awareness among consumers regarding the importance of title insurance, which is significantly influencing the Title Insurance Market. As more individuals recognize the potential risks associated with property ownership, such as liens or ownership disputes, the demand for title insurance is likely to increase. Surveys indicate that approximately 70% of homebuyers now consider title insurance a necessary part of their real estate transactions. This heightened awareness is prompting title insurance providers to enhance their marketing strategies and educational efforts, thereby expanding their reach and customer base. Consequently, the increased awareness of title insurance is a crucial driver for the Title Insurance Market.