Regulatory Changes

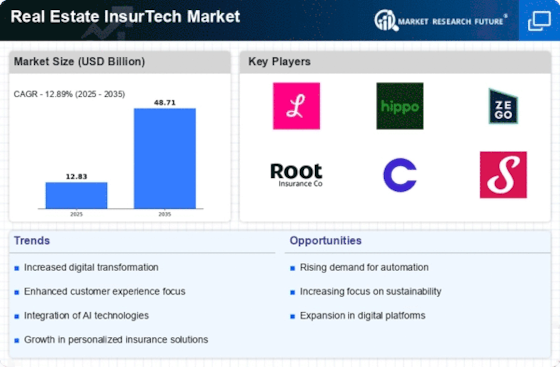

The Real Estate InsurTech Market is currently experiencing a wave of regulatory changes that are reshaping the landscape of insurance and real estate transactions. Governments are increasingly implementing regulations aimed at enhancing transparency and consumer protection. For instance, the introduction of data privacy laws has compelled InsurTech companies to adopt more robust data management practices. This regulatory environment not only fosters trust among consumers but also encourages innovation within the industry. As a result, companies that can navigate these regulations effectively are likely to gain a competitive edge. The market is projected to grow as these regulations evolve, with estimates suggesting a compound annual growth rate of around 10% over the next five years.

Shift Towards Customization

The Real Estate InsurTech Market is experiencing a notable shift towards customization in insurance products. Consumers are increasingly seeking tailored solutions that meet their specific needs rather than one-size-fits-all policies. This trend is prompting InsurTech companies to develop innovative products that allow for greater flexibility and personalization. For instance, modular insurance policies enable customers to select coverage options that align with their unique circumstances. This customization trend is supported by data indicating that 70% of consumers are willing to pay a premium for personalized insurance solutions. As this demand grows, InsurTech firms that prioritize customization are likely to capture a larger share of the market, potentially leading to a market expansion of 12% over the next few years.

Data Analytics and AI Adoption

The Real Estate InsurTech Market is increasingly leveraging data analytics and artificial intelligence to enhance risk assessment and underwriting processes. By utilizing advanced algorithms and machine learning techniques, InsurTech firms can analyze vast amounts of data to identify trends and predict potential risks more accurately. This capability not only streamlines operations but also allows for more personalized insurance offerings tailored to individual customer needs. The integration of AI in underwriting processes has been shown to reduce processing times by up to 30%, thereby improving overall efficiency. As the industry continues to embrace these technologies, the market is likely to see a significant transformation, with projections indicating a potential market size increase of 15% annually.

Sustainability and Green Initiatives

The Real Estate InsurTech Market is increasingly aligning with sustainability and green initiatives, reflecting a broader societal shift towards environmental responsibility. InsurTech companies are developing products that incentivize eco-friendly practices, such as discounts for properties with energy-efficient features. This trend is not only appealing to environmentally conscious consumers but also aligns with regulatory pressures for sustainable development. Recent studies indicate that properties with green certifications can command up to 20% higher premiums, highlighting the financial benefits of sustainability. As awareness of environmental issues continues to rise, the market is expected to grow, with projections suggesting that sustainable insurance products could account for a significant portion of the market by 2027.

Increased Demand for Digital Solutions

The Real Estate InsurTech Market is witnessing a surge in demand for digital solutions, driven by the need for efficiency and convenience in property transactions. Consumers are increasingly favoring online platforms that offer seamless experiences, from property search to insurance procurement. This shift is reflected in the growing adoption of mobile applications and online portals, which facilitate quicker decision-making and enhance user engagement. According to recent data, approximately 60% of consumers prefer digital channels for their insurance needs, indicating a significant shift in consumer behavior. As InsurTech companies continue to innovate and provide user-friendly solutions, the market is expected to expand, potentially reaching a valuation of over $10 billion by 2026.