Tile Grout Size

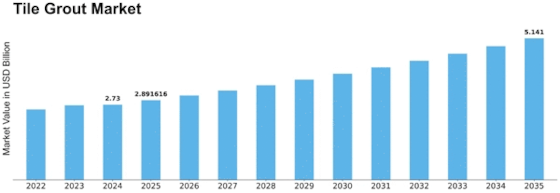

Tile Grout Market Growth Projections and Opportunities

The Tile Grout market is subject to a myriad of factors that collectively influence its dynamics. One of the primary drivers is the robust growth in the construction and renovation sector. As construction activities surge globally, the demand for tile grout, a crucial component in tile installation, witnesses a corresponding rise. The versatile nature of tile grout, which fills gaps between tiles, enhances aesthetics, and provides structural integrity, contributes to its increasing adoption in residential, commercial, and industrial construction projects.

Tile grout is a type of concrete used to fill gaps. It is in fluid form. This grout is produced from a mixture of sand, water, and cement which is used for pressure grouting, connecting sections of precast concrete, sealing joints between tiles, embedding rebar in masonry walls, and filling voids. To fill the large gaps like the cores of concrete blocks, tile grout is mixed with fine gravel.

Economic factors play a pivotal role in shaping the Tile Grout market. The health of the economy, including factors like GDP growth, consumer spending, and interest rates, directly impacts construction and renovation activities. During periods of economic growth, increased construction projects and higher consumer confidence drive the demand for tile grout. Conversely, economic downturns may lead to a slowdown in construction, affecting the market negatively.

Innovation in tile grout formulations and application technologies is a significant factor influencing the market. Manufacturers continually invest in research and development to introduce grout products with enhanced performance, durability, and ease of use. New formulations address challenges such as color fading, cracking, and mold growth, improving the overall quality and longevity of tile installations. Advanced application technologies also contribute to efficient and precise grout application, attracting users seeking modern and effective solutions.

Consumer preferences and design trends are essential factors in the Tile Grout market. As consumers increasingly prioritize aesthetics and personalization in interior design, the demand for a diverse range of grout colors and finishes has grown. The market responds with a variety of grout options, allowing users to customize their tile installations and achieve desired visual effects. Additionally, the popularity of large-format tiles and intricate tile patterns influences the need for specialized grout formulations to meet specific design requirements.

Environmental considerations have a significant impact on the Tile Grout market. With an increasing focus on sustainable and eco-friendly building materials, manufacturers are developing grout products with reduced environmental impact. Low-VOC (volatile organic compound) and eco-friendly formulations cater to environmentally conscious consumers and align with green building certifications. The market is witnessing a shift towards more sustainable practices in response to the growing awareness of environmental issues.

Government regulations and building codes also influence the Tile Grout market. Many countries and regions have specific regulations related to construction materials, including grout. Compliance with these standards is essential for manufacturers to ensure product safety, performance, and environmental responsibility. Government initiatives promoting energy-efficient and sustainable construction further contribute to the adoption of compliant and eco-friendly grout solutions.

Global trends, such as urbanization and the rise of smart homes, impact the Tile Grout market. Urbanization leads to increased construction activities in residential and commercial spaces, driving the demand for tile grout. The trend towards smart homes and modern interior design influences the market by fostering the use of advanced grout formulations that complement contemporary design preferences and technologies.

Market competition and the presence of key players are additional factors shaping the Tile Grout market. The industry's competitive landscape encourages innovation and quality improvement. Key players often differentiate themselves by offering a diverse range of grout products, providing technical support, and establishing strong distribution networks. This competition contributes to a dynamic market with continuous advancements in product offerings and customer-focused solutions.

Leave a Comment