Market Trends

Key Emerging Trends in the Threat Intelligence Market

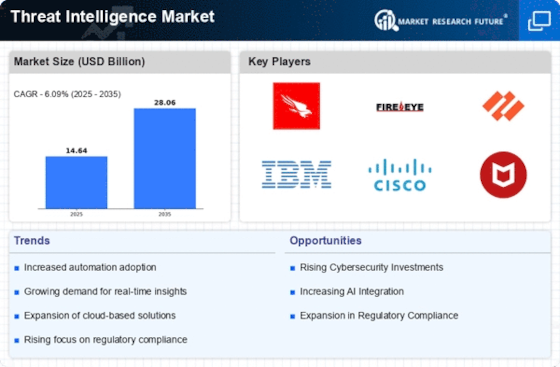

The Threat Intelligence market is undergoing dynamic changes, reflecting the evolving landscape of cybersecurity and the increasing sophistication of cyber threats. Threat intelligence involves the collection and analysis of information about cyber threats to identify potential risks and vulnerabilities. Some trends in the markets are specially shaping the market of Threat intelligence, which shows that this is providing organizations with a proactive defense against cyber-attacks. The increase in request for actionable threat intelligence is one of the major trends in the market of threat intelligence. Organizations require threat intelligence data feeds which provide more than dumps of data but insights which are appropriate, accurate, and suitable to carry out defensive measures. The focus is on transforming threat data into valuable intelligence which protects security teams by providing them with the right information to make the best decisions, to prioritize and mitigate relevant threats, and to strengthen the cybersecurity posture. In order to handle the things, threat intelligence providers are beginning to deliver contextualized information that helps organizations to understand specific threats that they may be facing and to mitigate them targetedly. As the market transition from traditional threat intelligence to more collaborative and community-centered threat intelligence sharing, they are also seeing a shift in the current marketplace. Information sharing platforms and the industry-specific threat intelligence sharing consultations gain an impact. Organizations understand that collective intelligence plays an important role in the fight against cyber threats, since if they exchange the analysis insights and indicators of compromise (IoCs), the whole community of cybersecurity will benefit. Subsequently, this forms a new trend of collective cybersecurity, in which organizations work together and share resources to tackle common security challenges. One other significant thr…eat is the report integration of threat intelligence into the broader cybersecurity environment. The inclusion of threat intelligence feeds into SIEM systems, endpoint protection platforms, and other security tools is now commonplace to increase the ability to detect, respond, and mitigate threats. Moreover, the Threat Intelligence market is also becoming sophisticated by integrating advanced analytics and machine learning technologies in response to the growing complexity of cyber threats. Threat intelligence organizations are adopting these technologies to analyze large volumes of data, detect patterns and determine what possible attacks might come up next. The combination of artificial intelligence (AI) and machine learning provides for more proactive threat identification, shorter response times, and the capability to revel intricate and complex breach attempts that may go through the traditional security measures undetected. The use of standard formats, for instance STIX (Structured Threat Information eXpression) and TAXI (Trusted Automated eXchange of Indicators) improves the interoperability of the threat intelligence and reduces the integration impediments with different cybersecurity platforms. Besides the positive signals that have shown, there are still hurdles to overcome in the threat intelligence market, such as the need for better threat attribution, data quality, and evolving methods of the threat actors. Attribution, precisely naming and protecting the source of cyber attacks, is currently a major challenge. remains a complex task. Threat intelligence providers are working on enhancing attribution capabilities to provide more accurate information about the origin and motives behind cyber threats. Additionally, ensuring the quality and reliability of threat intelligence data is an ongoing challenge, as inaccuracies or false positives can lead to ineffective security measures.

Leave a Comment