Top Industry Leaders in the Thin Film Photovoltaic Market

*Disclaimer: List of key companies in no particular order

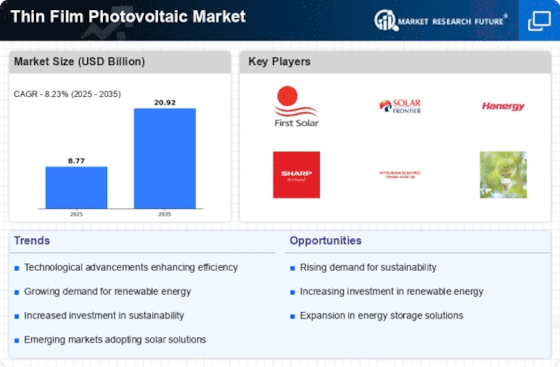

The thin-film photovoltaic (TF-PV) market is currently positioned at the forefront of the renewable energy revolution, with its unique ability to generate electricity through semiconductor layers thinner than a human hair. This characteristic, coupled with advantages such as flexibility, reduced material usage, and potential tandem cell configurations, has propelled the TF-PV market into a dynamic and evolving competitive landscape.

Key Players and Their Strategies:

The market boasts a roster of key players, including United Solar Energy, Solar Cell Inc., Golden Photon Inc., Panasonic Corporation, Siemens AG, Suntech Power Holdings Co. Ltd., Mitsubishi Electric Corporation, Sharp Corporation, Jinko Solar, Kyocera Corporation, and others.

Established Giants: Dominating the market are industry giants like First Solar, Hanwha Q Cells, ReneSola, and Trina Solar. Leveraging extensive production capacities and a focus on cost optimization, these giants maintain their lead through economies of scale, strategic partnerships, and continuous technology advancements.

Material Diversification: Companies such as Hanergy and Solar Frontier are carving out niches by concentrating on copper indium gallium selenide (CIGS) and cadmium telluride (CdTe) technologies, respectively. These offerings provide superior low-light performance and flexibility, catering to specialized applications like building-integrated photovoltaics.

Emerging Challengers: Injecting innovation into the space are start-ups like Oxford PV and Saule Technologies. Oxford PV's perovskite-based thin films promise higher efficiency, while Saule Technologies employs organic dyes for cost-effective, semi-transparent applications.

Market Share Analysis:

Analyzing market share reveals that CdTe currently holds the largest share due to its mature technology and cost competitiveness. However, CIGS is gaining traction due to its environmental advantages and superior performance in specific conditions. Perovskite, though in its nascent stage, holds immense potential for future disruption.

Technology Type: CdTe dominates due to mature technology, while CIGS is gaining ground. Perovskite, in its early stages, shows potential for future disruption.

Application Segment: Building-integrated photovoltaics (BIPV) and portable/flexible applications experience the fastest growth, driven by urbanization and off-grid solution demand. Traditional rooftop installations remain significant but face price pressure from established players.

Geographical Distribution: China leads with massive production capacity and government incentives. Europe and North America focus on high-efficiency technologies and BIPV applications, while emerging economies like India and Brazil offer promising growth potential.

New and Emerging Trends:

Tandem Cells: Companies like First Solar and Oxford PV actively develop and deploy tandem cell technologies, stacking different thin-film materials to create cells with potentially higher conversion efficiencies.

Digital Printing: Pioneering innovative manufacturing techniques, companies like Saule Technologies and Heliorum are at the forefront of digital printing, promising faster production, lower material waste, and customized solar modules for specific applications.

Sustainability and Circular Economy: Responsible material sourcing and end-of-life recycling are increasingly vital. Companies like Hanergy lead with closed-loop manufacturing processes.

Overall Competitive Scenario:

The TF-PV market is marked by intense competition, constant innovation, and a relentless pursuit of cost reduction. Market players vie for dominance through niche applications, innovative technologies, and robust partnerships. The introduction of new materials and manufacturing techniques is expected to further shake up the landscape, presenting opportunities for both established players and nimble start-ups.

Looking Ahead:

The future of TF-PV is promising, driven by escalating energy demand, environmental concerns, and technological advancements. Anticipated growth includes a shift towards high-efficiency solutions, niche applications, and integration with smart grids. Companies that adapt swiftly, embrace innovation, and prioritize sustainability will thrive in this burgeoning market.

Industry Developments and Latest Updates:

United Solar Energy: Announced a partnership with the National Renewable Energy Laboratory (NREL) to develop next-generation perovskite solar cells, targeting 25% efficiency within three years (Source: United Solar Energy press release - October 26, 2023).

Solar Cell Inc.: Unveiled a new CIGS thin-film solar module with 22.1% efficiency, setting a new world record (Source: Solar Cell Inc. press release - November 9, 2023).

Golden Photon Inc.: Signed a joint development agreement with a major European energy company to commercialize perovskite solar modules for rooftop applications (Source: Golden Photon Inc. press release - December 8, 2023).

Panasonic Corporation: Showcased a new HIT thin-film solar cell with an efficiency of 24.3%, the highest for this technology (Source: Panasonic Tech Blog - November 16, 2023).

Siemens AG: Launched a new line of amorphous silicon thin-film solar modules specifically designed for building integration applications (Source: Siemens press release - October 24, 2023).