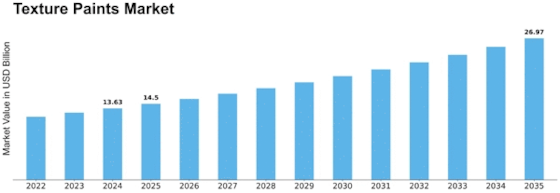

Texture Paints Size

Texture Paints Market Growth Projections and Opportunities

Texture paints have become a popular choice for homeowners and businesses alike, primarily influenced by several market factors. Firstly, aesthetic preferences play a significant role. Consumers often seek a unique and visually appealing finish for their walls, which texture paints provide. These paints offer a tactile quality, adding depth and character to surfaces, meeting the demand for distinctive interior and exterior designs.

The size of Texture Paint Market was around USD 14.13 Billion by revenue, at the end of 2021 and is anticipated to grow at a CAGR of 7.97 % to reach close to USD 18.62 Billion by the end of 2030.

Additionally, the durability and functional aspects of texture paints contribute to their market prominence. Many textures paints are formulated to withstand wear and tear, making them suitable for high-traffic areas and diverse environmental conditions. The ability to cover imperfections on walls also appeals to consumers seeking a practical solution for uneven surfaces or blemishes, reducing the need for extensive wall preparation.

Moreover, market trends and innovations influence the texture paint industry. Advancements in paint technology continually introduce new textures, finishes, and application methods, expanding choices for consumers. As sustainability gains traction in various industries, eco-friendly texture paints made from low-VOC (Volatile Organic Compounds) and environmentally responsible materials experience increased demand.

Cost-effectiveness is another pivotal market factor driving the popularity of texture paints. While prices vary based on quality and brand, these paints often provide value for money due to their longevity and coverage capabilities. Consumers perceive texture paints as an investment that enhances property value and requires less frequent repainting, making them an attractive choice despite potentially higher initial costs.

Furthermore, the influence of market dynamics such as advertising, consumer education, and brand reputation cannot be understated. Effective marketing strategies by paint manufacturers and retailers showcasing the versatility and advantages of texture paints significantly impact consumer purchasing decisions. Moreover, educational initiatives that highlight application techniques and design possibilities help consumers understand the benefits, driving interest and sales.

Local and global economic factors also play a role in the texture paint market. Economic stability and growth often correlate with increased construction and renovation activities, boosting demand for texture paints. Conversely, economic downturns may affect consumer spending on home improvement projects, impacting the market for texture paints.

Lastly, the accessibility and availability of texture paints contribute to their market factors. These paints are commonly found in various retail outlets, specialty stores, and online platforms, ensuring widespread accessibility to consumers. Additionally, the ease of application and DIY-friendly nature of some texture paints further broadens their market appeal, attracting individuals keen on undertaking home improvement projects themselves.

Leave a Comment