Rising Cybersecurity Threats

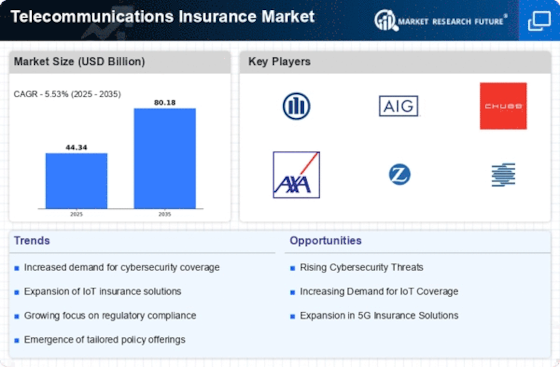

The Telecommunications Insurance Market is experiencing a notable increase in demand for insurance products that cover cybersecurity threats. As telecommunications companies face escalating risks from cyberattacks, the need for comprehensive insurance solutions becomes paramount. In 2025, it is estimated that the cost of cybercrime could reach trillions of dollars, prompting companies to seek protection against potential financial losses. This trend indicates a shift in focus towards policies that not only cover traditional risks but also address the complexities of digital threats. Insurers are responding by developing specialized products tailored to the unique challenges faced by telecommunications providers, thereby enhancing the overall resilience of the industry.

Regulatory Compliance Requirements

The Telecommunications Insurance Market is significantly influenced by the evolving landscape of regulatory compliance. Governments and regulatory bodies are increasingly mandating that telecommunications companies maintain certain levels of insurance coverage to protect consumers and ensure service continuity. This regulatory pressure is likely to drive demand for insurance products that meet these compliance standards. In 2025, it is projected that compliance-related insurance products will account for a substantial portion of the market, as companies strive to align with legal requirements. This trend not only fosters a more secure telecommunications environment but also encourages insurers to innovate and offer products that cater to these compliance needs.

Technological Advancements in Telecommunications

The Telecommunications Insurance Market is being shaped by rapid technological advancements that are transforming the way services are delivered. Innovations such as 5G technology and the Internet of Things (IoT) are creating new opportunities and risks for telecommunications providers. As these technologies proliferate, the complexity of insuring telecommunications operations increases. In 2025, it is anticipated that the integration of advanced technologies will lead to a rise in demand for specialized insurance products that address the unique risks associated with these innovations. Insurers are likely to adapt their offerings to encompass coverage for emerging technologies, thereby enhancing the overall stability and security of the telecommunications sector.

Growing Awareness of Business Continuity Planning

The Telecommunications Insurance Market is experiencing a shift towards greater awareness of business continuity planning among telecommunications providers. As companies recognize the importance of maintaining operations during unforeseen disruptions, the demand for insurance products that support business continuity is likely to increase. In 2025, it is projected that a significant portion of the telecommunications sector will prioritize insurance solutions that address potential operational interruptions. This trend indicates a growing understanding of the need for robust risk management strategies, prompting insurers to develop tailored products that align with the specific continuity needs of telecommunications companies.

Increased Competition Among Telecommunications Providers

The Telecommunications Insurance Market is witnessing heightened competition among service providers, which in turn influences the demand for insurance products. As companies strive to differentiate themselves in a crowded marketplace, they are increasingly recognizing the importance of risk management strategies, including insurance coverage. In 2025, it is expected that competitive pressures will drive telecommunications companies to seek comprehensive insurance solutions that not only protect their assets but also enhance their market positioning. This trend may lead to the development of innovative insurance products that cater specifically to the needs of competitive telecommunications firms, thereby fostering a more dynamic insurance landscape.