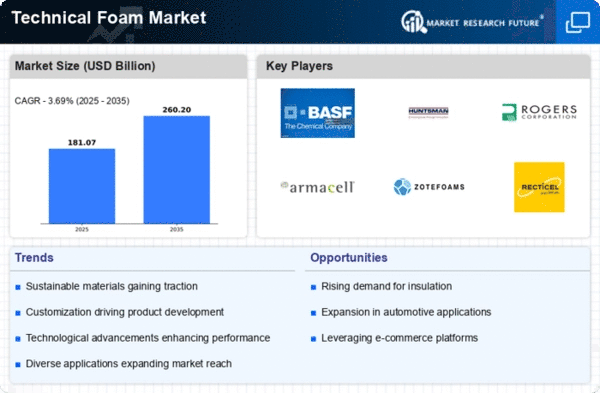

Market Growth Projections

The Global Technical Foam Market Industry is projected to grow from 174.6 USD Billion in 2024 to 260.2 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.69% from 2025 to 2035. This growth trajectory indicates a robust demand for technical foams across various sectors, including automotive, construction, and healthcare. The increasing applications of these materials, coupled with advancements in technology and sustainability initiatives, suggest a dynamic market landscape. As industries continue to innovate and adapt to changing consumer preferences, the technical foam market is poised for significant expansion in the coming years.

Increased Focus on Sustainability

Sustainability has become a pivotal concern across industries, influencing the Global Technical Foam Market Industry. Manufacturers are increasingly adopting eco-friendly materials and processes to meet consumer demand for sustainable products. The use of recycled materials in the production of technical foams is gaining traction, aligning with global efforts to reduce waste and carbon footprints. This shift towards sustainability not only addresses environmental concerns but also opens new market opportunities. As regulations surrounding sustainability tighten, companies that prioritize eco-friendly practices are likely to gain a competitive edge, further propelling market growth.

Growing Demand in Automotive Sector

The automotive industry is a significant driver of the Global Technical Foam Market Industry, as manufacturers increasingly utilize technical foams for sound insulation, vibration dampening, and lightweighting. The shift towards electric vehicles and the need for enhanced fuel efficiency are propelling the demand for lightweight materials, including technical foams. In 2024, the market is valued at 174.6 USD Billion, with projections indicating a robust growth trajectory. The automotive sector's focus on reducing weight and improving energy efficiency suggests that technical foams will play a crucial role in meeting these objectives, thereby contributing to the overall market expansion.

Rising Applications in Construction

The construction sector is witnessing a surge in the adoption of technical foams due to their thermal insulation properties and lightweight characteristics. These materials are increasingly used in insulation panels, roofing, and flooring applications, which enhances energy efficiency in buildings. The Global Technical Foam Market Industry is expected to benefit from stringent building codes and regulations aimed at improving energy efficiency. As urbanization continues to rise globally, the demand for sustainable construction materials is likely to increase, further driving the market. This trend indicates a potential for growth as the construction industry seeks innovative solutions to meet environmental standards.

Expansion of Healthcare Applications

The healthcare sector is increasingly recognizing the benefits of technical foams, which are utilized in medical devices, cushioning, and protective equipment. The Global Technical Foam Market Industry is experiencing growth as healthcare providers seek materials that offer comfort, support, and protection for patients. The ongoing advancements in medical technology and the rising demand for high-quality medical products are likely to drive the adoption of technical foams in this sector. As the healthcare industry continues to expand, the potential for technical foams to enhance patient care and safety suggests a promising outlook for market growth.

Technological Advancements in Material Science

Innovations in material science are significantly influencing the Global Technical Foam Market Industry. The development of new formulations and manufacturing processes enhances the performance characteristics of technical foams, such as durability, flexibility, and resistance to environmental factors. These advancements enable the production of specialized foams tailored for specific applications across various industries, including healthcare, packaging, and consumer goods. As companies invest in research and development to create high-performance foams, the market is likely to experience an uptick in demand. This trend suggests that technological progress will continue to be a key driver of market growth.