Top Industry Leaders in the Tag Management Software Market

Competitive Landscape of Tag Management Software Market

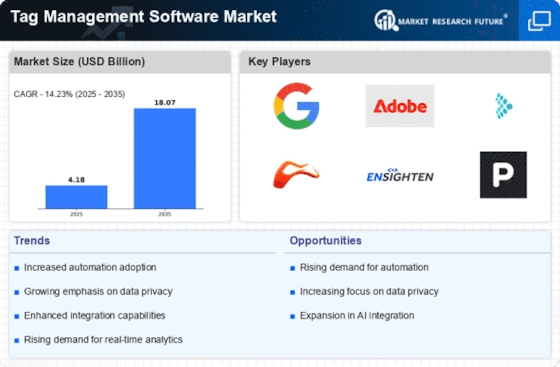

The tag management software (TMS) market is experiencing robust growth, fueled by the ever-increasing reliance on data-driven marketing and the need for efficient tag deployment across websites and apps. This dynamic landscape is home to a diverse array of players, each employing distinct strategies to carve their niche. Understanding this competitive landscape is crucial for both established and emerging companies seeking to navigate the market successfully.

Key Players:

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Adobe Systems Inc. (U.S.)

- Tealium (U.S.)

- Ensighten (U.S.)

- Oracle Corporation (U.S.)

- Adform (Denmark)

- AT Internet (France)

- Commanders Act (France)

- Datalicious (Australia)

- Matomo (U.S.)

- Mezzobit (U.S.)

- Qubit (U.K.)

- Relay 42 (Netherlands)

- Segment (U.S.)

- Signal (U.S.)

- Sizmek (U.S.)

- Piwik Pro (U.S.)

- Innocraft (New Zealand)

- Yottaa (U.S.)

- Datalicious Pty Ltd (Australia)

- Hub’Scan (U.S.)

- Rakuten Inc. (Japan)

Strategies Adopted by Key Players:

- Enterprise Leaders: Adobe (Tealium), Google (Tag Manager 360), Salesforce (Krux), Oracle (BlueKai), and Nielsen (DMP) dominate the market with feature-rich platforms, catering to large enterprises with complex needs. Their strategies revolve around continuous innovation, strategic acquisitions, and integration with broader marketing cloud offerings.

- Mid-Tier Players: Webtrends, Sitecore, and Optimizely target mid-sized businesses with user-friendly interfaces and competitive pricing. They focus on ease of use, pre-built integrations, and strong customer support to win over less tech-savvy customers.

- Niche Players: Consent management platforms (CMPs) like OneTrust and IAB Europe Transparency & Consent Framework (TCF) address specific compliance needs. They compete on data privacy expertise and industry-specific integrations, catering to sectors with stringent data regulations.

Factors for Market Share Analysis:

- Feature Set: The breadth and depth of features offered, including tag deployment, data collection, integration capabilities, and analytics tools, significantly impact market share.

- Ease of Use: Simple interfaces, drag-and-drop functionality, and intuitive workflows are critical for user adoption, especially among non-technical teams.

- Pricing Models: Flexible and scalable pricing options cater to different budgets and business sizes, influencing market penetration.

- Data Privacy Compliance: Adherence to data privacy regulations, including GDPR and CCPA, has become a key differentiator, especially in Europe and California.

- Customer Support: Responsive and knowledgeable support teams are essential for building trust and loyalty.

New and Emerging Companies:

Several startups are disrupting the market with innovative solutions:

- Consent Management Platforms (CMPs): Companies like Osano and TrustArc offer comprehensive CMP solutions that simplify data privacy compliance for businesses.

- Customer Data Platforms (CDPs): Hybrid solutions like Segment and mParticle combine tag management with CDP capabilities, providing a unified view of customer data.

- AI-powered Tag Optimization: Companies like Signal and Tealium IQ leverage AI to automatically optimize tag deployment and data collection, improving efficiency and ROI.

Current Company Investment Trends:

- Integration with Marketing Clouds: Leading players are focusing on integrating their TMS with broader marketing cloud offerings, creating a unified platform for all marketing activities.

- Focus on AI and Machine Learning: Implementing AI and ML for automation, data analysis, and predictive insights is a key investment area for many companies.

- International Expansion: Targeting new markets, particularly in Asia and Latin America, is a growth strategy for established players and ambitious startups.

- Partnership and Acquisitions: Strategic partnerships and acquisitions with complementary technology providers are common tactics to expand offerings and market reach.

Latest Company Updates:

In 2023, Adobe on Tuesday unveiled a number of new generative AI improvements spanning its main product lines, as Big Tech scrambles to maximise the excitement surrounding the artificial intelligence that can create its content, including writing and graphics. Along with releasing three new AI models for Firefly, Adobe's generative AI imaging tool, the software behemoth also enhanced Photoshop's text-to-image capabilities and introduced features to Illustrator and Adobe Express.

Leading affiliate monitoring provider Cellxpert 2023 announced today that their improved "Tag Manager" feature is now available to affiliate programme managers. System administrators can more effectively categorise and segment their affiliate partners for more organised workflow and increased productivity with the aid of the new custom tag management feature. Administrators can now handle a wide range of affiliates more easily thanks to this innovative functionality, which helps them deal with the increased complexity of managing huge affiliate programmes and partner kinds. The recently added "Manage Tags" area makes it easier to find affiliate partners or groups by using customised tags that are personal to you.