Synthetic Rubber Size

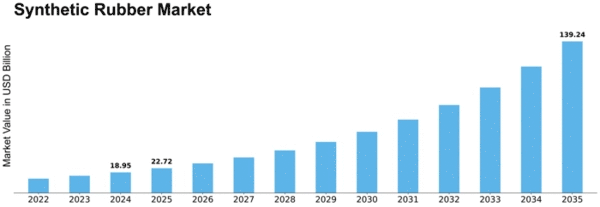

Synthetic Rubber Market Growth Projections and Opportunities

The synthetic rubber market is influenced by a multitude of factors that affect its supply, demand, and pricing dynamics. One of the primary market factors is the overall economic conditions prevailing in key regions across the globe. Economic growth, industrial production levels, and consumer spending patterns play a significant role in determining the demand for synthetic rubber, as it is widely used in various industries such as automotive, construction, and manufacturing.

Synthetic Rubber is a kind of elastic polymer mainly derived from petroleum byproducts. Synthetic Rubber possess various properties such as elasticity, oil resistant, durability, and excellent water repellant property which make them suitable for various end use industries such as construction, footwear, automotive & transportation, industrial, and others. Moreover, it is used for making polymer concrete for waterproofing, tires, hoses, conveyor belt covers, gaskets, tubes, and others.

Moreover, the automotive industry is a major driver of demand for synthetic rubber. As the production and sales of automobiles increase or decrease, so does the demand for synthetic rubber used in tires, hoses, belts, and other automotive components. Additionally, government regulations and policies related to vehicle emissions, fuel efficiency, and safety standards can influence the type and quantity of synthetic rubber required by automakers.

Another critical factor affecting the synthetic rubber market is the price and availability of raw materials used in its production. Synthetic rubber is typically derived from petrochemical feedstocks such as crude oil and natural gas, so fluctuations in the prices of these commodities can impact the cost of producing synthetic rubber. Additionally, the availability of alternative raw materials or substitutes, such as natural rubber or bio-based polymers, can also influence market dynamics.

Technological advancements and innovations in manufacturing processes play a crucial role in shaping the synthetic rubber market. Improvements in production efficiency, product quality, and environmental sustainability can give manufacturers a competitive edge and drive market growth. Research and development efforts aimed at developing new types of synthetic rubber with enhanced properties, such as durability, flexibility, and resistance to extreme temperatures and chemicals, can also create opportunities for market expansion.

Furthermore, environmental and sustainability concerns are increasingly influencing the synthetic rubber market. As awareness of climate change and environmental pollution grows, there is a growing demand for eco-friendly and renewable alternatives to traditional synthetic rubber. This has led to the development of bio-based synthetic rubber derived from renewable resources such as plants, algae, and waste materials. Companies that prioritize sustainability and offer environmentally friendly products may gain a competitive advantage in the market.

The geopolitical landscape and trade policies also impact the synthetic rubber market, particularly in terms of supply chain disruptions and trade tensions between major producing and consuming countries. Tariffs, sanctions, and trade agreements can affect the flow of synthetic rubber and its raw materials across borders, leading to fluctuations in prices and availability. Additionally, geopolitical instability in key producing regions, such as the Middle East and Southeast Asia, can pose risks to the global supply of synthetic rubber.

Consumer preferences and trends are increasingly influencing the synthetic rubber market, particularly in industries such as footwear, sports equipment, and consumer electronics. As consumers become more conscious of the environmental and social impact of the products they purchase, there is a growing demand for sustainable and ethically sourced materials, including synthetic rubber. Companies that can adapt to changing consumer preferences and offer products that align with sustainability goals may gain a competitive advantage in the market.

Leave a Comment