Enhanced Data Availability

The Synthetic Data Generation Market is benefiting from the growing need for enhanced data availability. Traditional data collection methods often face limitations, such as high costs and time constraints, which can hinder the development of machine learning models. Synthetic data offers a viable alternative by providing abundant, high-quality datasets that can be generated quickly and at a lower cost. This capability is particularly advantageous for industries such as healthcare and finance, where data scarcity can impede innovation. By utilizing synthetic data, organizations can create diverse datasets that reflect various scenarios, thereby improving the robustness of their models. The market is witnessing a notable increase in the adoption of synthetic data solutions, with projections indicating that the market could reach several billion dollars in value within the next few years, driven by the need for readily available data.

Increasing Regulatory Compliance

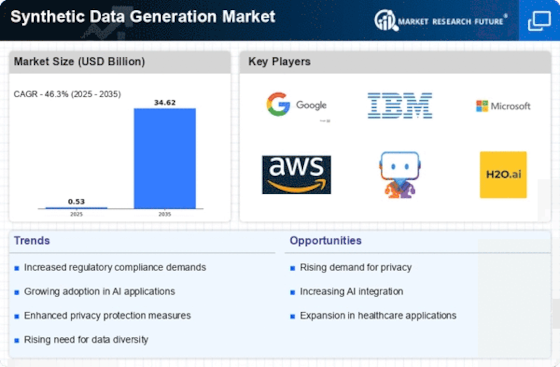

The Synthetic Data Generation Market is experiencing a surge in demand due to the increasing regulatory compliance requirements across various sectors. Organizations are compelled to adhere to stringent data protection laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These regulations necessitate the use of synthetic data to ensure that sensitive information is not exposed during data analysis and model training. As a result, businesses are increasingly turning to synthetic data solutions to mitigate risks associated with data breaches and non-compliance. The market for synthetic data is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 30% in the coming years. This trend indicates a robust demand for synthetic data solutions that can help organizations navigate the complexities of regulatory landscapes.

Growing Focus on AI and Machine Learning

The Synthetic Data Generation Market is closely linked to the growing focus on artificial intelligence (AI) and machine learning (ML) technologies. As organizations increasingly adopt AI and ML for data-driven decision-making, the demand for high-quality training data has surged. Synthetic data serves as a crucial resource, enabling companies to train their algorithms without compromising sensitive information. This trend is particularly evident in sectors such as automotive, where autonomous vehicle development relies heavily on vast amounts of data for training. The market for synthetic data is projected to expand significantly, with estimates suggesting a CAGR of around 25% over the next few years. This growth reflects the increasing reliance on synthetic data to fuel AI and ML advancements, thereby enhancing the overall capabilities of these technologies.

Advancements in Data Generation Technologies

The Synthetic Data Generation Market is propelled by advancements in data generation technologies. Innovations in algorithms and computational power have significantly enhanced the ability to create realistic synthetic datasets that closely mimic real-world data distributions. These advancements enable organizations to generate high-fidelity data that can be used for training machine learning models, testing software applications, and conducting simulations. The market is experiencing a notable uptick in the adoption of these advanced synthetic data generation techniques, with estimates suggesting a potential market size of several billion dollars in the coming years. As organizations seek to leverage the benefits of synthetic data, the continuous evolution of data generation technologies is likely to play a pivotal role in shaping the future landscape of the Synthetic Data Generation Market.

Cost-Effectiveness of Synthetic Data Solutions

The Synthetic Data Generation Market is witnessing a shift towards cost-effective data solutions. Traditional data collection and annotation processes can be prohibitively expensive and time-consuming, particularly for organizations with limited budgets. Synthetic data generation offers a more economical alternative, allowing businesses to create large volumes of data without incurring the high costs associated with traditional methods. This cost-effectiveness is particularly appealing to startups and smaller enterprises that require access to quality data for model training and validation. As a result, the market for synthetic data is expected to grow, with projections indicating that it could reach a valuation of several billion dollars in the near future. The increasing recognition of synthetic data as a viable and affordable solution is likely to drive further adoption across various industries.