Top Industry Leaders in the Syngas Market

The syngas market, a burgeoning segment of the energy landscape, is experiencing a surge in interest due to its versatility and potential for decarbonization. This gas, a mixture of hydrogen, carbon monoxide, and other gases derived from various feedstocks like coal, natural gas, and biomass, holds immense promise for diverse applications, from power generation to chemical production. However, navigating the competitive landscape of this dynamic market requires a deep understanding of the key players, their strategies, and the factors shaping market share.

Strategies Adopted by Market Leaders:

Diversification: Leading companies like Shell, ExxonMobil, and Linde are actively diversifying their syngas production sources, exploring renewable feedstocks like biomass and biogas alongside traditional fossil fuels. This strategy aims to cater to the growing demand for sustainable syngas and mitigate carbon footprint.

Technological Advancements: Players are investing heavily in research and development to improve syngas production efficiency and reduce emissions. This includes advances in gasification technologies, cleaner syngas purification processes, and carbon capture and storage (CCS) integration.

Regional Expansion: Companies are strategically expanding their operations into high-growth regions like Asia-Pacific, driven by the increasing demand for syngas in these markets. This involves establishing joint ventures, acquiring local players, and building new production facilities.

Vertical Integration: Some companies are adopting vertical integration strategies, controlling the entire value chain from feedstock sourcing to syngas production and downstream applications. This helps optimize costs, secure supply chains, and offer integrated solutions to customers.

Partnerships and Collaborations: Collaboration is a key driver in the syngas market. Companies are partnering with research institutions, technology providers, and other stakeholders to accelerate innovation, share knowledge, and explore new market opportunities.

Factors Shaping Market Share:

Feedstock Availability and Cost: The availability and cost of feedstock significantly impact syngas production costs and market competitiveness. Companies with access to affordable and reliable feedstock sources have a distinct advantage.

Technological Expertise: Companies with advanced gasification technologies and efficient syngas purification processes can offer competitive pricing and attract customers.

Geographical Location: Proximity to major syngas demand centers and access to infrastructure like pipelines and transportation networks play a crucial role in market share.

Government Policies and Regulations: Stringent environmental regulations and government incentives for renewable energy sources can influence the market dynamics and favor companies with cleaner syngas production technologies.

Customer Relationships and Downstream Applications: Strong customer relationships and partnerships with downstream industries like chemicals, power generation, and transportation can secure long-term contracts and market share.

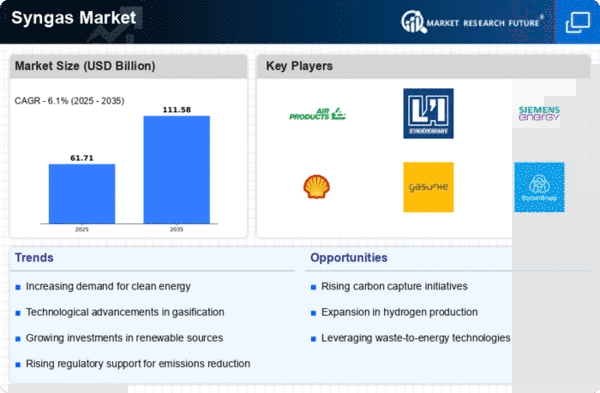

Key Companies in the Syngas market include

- Air Products and Chemicals Inc (US)

- Air Liquide (France)

- The Linde Group (Germany)

- Sasol (South Africa)

- Shell (Netherlands)

- Synthesis Energy Systems Inc. (US)

- Yankuang Group (China)

Recent Developments:

September 2023: ExxonMobil and Linde forge a partnership to develop and deploy advanced syngas cleaning technologies, aiming to reduce emissions and improve efficiency.

October 2023: The International Energy Agency (IEA) releases a report highlighting the potential of syngas in achieving net-zero emissions, emphasizing its role in decarbonizing various industries.

December 2023: Chevron enters the syngas market by acquiring a majority stake in a biomass gasification company, expanding its portfolio into renewable energy sources.