Data-Driven Decision Making

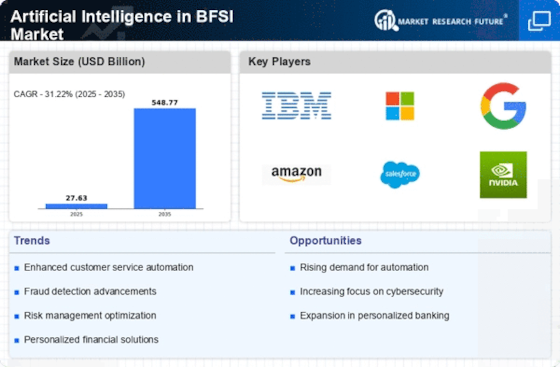

The proliferation of data within the BFSI sector has created an urgent need for advanced analytical tools. Artificial Intelligence in BFSI Market enables institutions to harness this data effectively, transforming it into actionable insights. By employing machine learning algorithms, financial organizations can analyze customer behavior, market trends, and operational efficiencies. This data-driven approach facilitates informed decision-making, allowing institutions to tailor their services to meet customer needs more precisely. According to recent estimates, organizations utilizing AI for data analytics have reported a 20% increase in operational efficiency. As the volume of data continues to expand, the reliance on AI for strategic decision-making is expected to intensify, further embedding Artificial Intelligence in BFSI Market into the core of financial operations.

Enhanced Cybersecurity Measures

As cyber threats continue to evolve, the BFSI sector faces increasing pressure to bolster its cybersecurity defenses. Artificial Intelligence in BFSI Market offers advanced solutions to detect and respond to potential threats in real-time. AI systems can analyze patterns in network traffic and user behavior to identify anomalies that may indicate a security breach. This proactive approach to cybersecurity not only protects sensitive financial data but also instills confidence among customers. With the global cost of cybercrime projected to reach trillions of dollars, investing in AI-driven cybersecurity measures is becoming imperative for financial institutions. The integration of AI into cybersecurity strategies is likely to redefine how the BFSI sector approaches risk management, making Artificial Intelligence in BFSI Market a cornerstone of modern security frameworks.

Operational Automation and Efficiency

The drive towards operational efficiency is a primary motivator for the adoption of Artificial Intelligence in BFSI Market. Financial institutions are increasingly leveraging AI technologies to automate routine tasks, such as data entry, transaction processing, and customer service inquiries. This automation not only reduces operational costs but also minimizes the potential for human error. For instance, chatbots powered by AI can handle customer queries 24/7, freeing up human resources for more complex tasks. Reports indicate that organizations implementing AI-driven automation have experienced a 30% reduction in processing times. As the pressure to enhance efficiency intensifies, the role of Artificial Intelligence in BFSI Market is expected to expand, driving innovation and productivity across the sector.

Personalization of Financial Services

The demand for personalized financial services is on the rise, driven by changing consumer expectations. Artificial Intelligence in BFSI Market plays a pivotal role in enabling institutions to offer tailored products and services. By analyzing customer data, AI can identify individual preferences and behaviors, allowing for the customization of financial solutions. This personalization enhances customer satisfaction and loyalty, as clients feel their unique needs are being addressed. For example, AI algorithms can recommend investment strategies based on a client's financial history and risk tolerance. As competition intensifies, the ability to deliver personalized experiences will likely become a key differentiator for financial institutions, underscoring the importance of Artificial Intelligence in BFSI Market.

Regulatory Compliance and Risk Mitigation

The increasing complexity of regulatory frameworks in the BFSI sector necessitates the adoption of Artificial Intelligence in BFSI Market. Financial institutions are compelled to comply with stringent regulations, which often require extensive data analysis and reporting. AI technologies can automate compliance processes, thereby reducing the risk of human error and enhancing accuracy. For instance, AI-driven solutions can analyze vast amounts of transaction data to identify anomalies that may indicate non-compliance. This capability not only streamlines compliance efforts but also mitigates potential financial penalties. As regulatory bodies continue to evolve their requirements, the demand for AI solutions that ensure adherence to these regulations is likely to grow, positioning Artificial Intelligence in BFSI Market as a critical component of risk management strategies.