-

Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Introduction

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

Macroeconomic Indicators

-

Detection Technique Trends & Assessment

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

Value Chain Analysis

-

Investment Feasibility Analysis

-

Pricing Analysis

-

Chapter 6. Global Surgical Drapes and Gowns Market, by Type

-

Introduction

-

Surgical Drapes

- General Procedure Drapes

- Cardiovascular Drapes

- C-Section Drapes

- Ophthalmic Drapes

- Laparoscopy Drapes

- Others

-

Surgical Gowns

- Standard Performance Gowns

- High-Performance Gowns

- Reinforced Gowns

-

Chapter 7. Global Surgical Drapes and Gowns Market, by Usage Pattern

-

Introduction

-

Disposable Surgical Drapes & Gowns

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Reusable Surgical Drapes & Gowns

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Chapter 8. Global Surgical Drapes and Gowns Market, by End User

-

Introduction

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Hospitals

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Ambulatory Surgical Centers

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Others

-

Market Estimates & Forecast, by Region, 2022-2030

-

Market Estimates & Forecast, by Country, 2022-2030

-

Chapter 9. Global Surgical Drapes and Gowns Market, by Region

-

Introduction

-

Americas

- North America

- South America

-

Europe

- Western Europe

- Eastern Europe

-

Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Chapter 10. Company Landscape

-

Introduction

-

Market Share Analysis

-

Key Developments & Strategies

-

Chapter 11. Company Profiles

-

Halyard Health

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cardinal Health

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

3M

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mölnlycke Health Care

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermo Fisher Scientific

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

STERIS Corporation

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Paul Hartmann AG

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Vivostat A/S

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Medica Europe B.V.

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Guardian

- Company Overview

- Type Overview

- Financials Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Others

-

Chapter 12. MRFR Conclusion

-

Key Findings

- From CEO’s View point

- Unmet Needs of the Market

-

Key Companies to Watch

-

Predictions for the Surgical Drapes and Gowns Industry

-

Chapter 13. Appendix

-

LIST OF TABLES

-

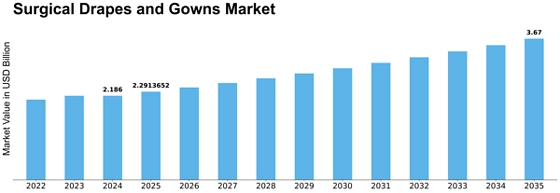

Global Surgical Drapes and Gowns Market Synopsis, 2022-2030

-

Global Surgical Drapes and Gowns Market Estimates and Forecast, 2022-2030 (USD Million)

-

Global Surgical Drapes and Gowns Market, by Region, 2022-2030 (USD Million)

-

Global Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Global Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Global Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

North America: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

North America: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

North America: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

US: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

US: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

US: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Canada: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Canada: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Canada: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

South America: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

South America: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

South America: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Europe: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Europe: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Europe: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Western Europe: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Western Europe: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Western Europe: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Eastern Europe: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Eastern Europe: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Eastern Europe: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Asia-Pacific: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Asia-Pacific: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Asia-Pacific: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

Middle East & Africa: Surgical Drapes and Gowns Market, by Type, 2022-2030 (USD Million)

-

Middle East & Africa: Surgical Drapes and Gowns Market, by Usage Pattern, 2022-2030 (USD Million)

-

Middle East & Africa: Surgical Drapes and Gowns Market, by End User, 2022-2030 (USD Million)

-

LIST OF FIGURES

-

Research Process

-

Segmentation for Global Surgical Drapes and Gowns Market

-

Segmentation Market Dynamics for Global Surgical Drapes and Gowns Market

-

Global Surgical Drapes and Gowns Market Share, by Type, 2022

-

Global Surgical Drapes and Gowns Market Share, by Usage Pattern, 2022

-

Global Surgical Drapes and Gowns Market Share, by End User, 2022

-

Global Surgical Drapes and Gowns Market Share, by Region, 2022

-

North America: Surgical Drapes and Gowns Market Share, by Country, 2022

-

Europe: Surgical Drapes and Gowns Market Share, by Country, 2022

-

Asia-Pacific: Surgical Drapes and Gowns Market Share, by Country, 2022

-

Middle East & Africa: Surgical Drapes and Gowns Market Share, by Country, 2022

-

Global Surgical Drapes and Gowns Market: Company Share Analysis, 2022 (%)

-

Halyard Health: Key Financials

-

Halyard Health: Segmental Revenue

-

Halyard Health: Geographical Revenue

-

Cardinal Health: Key Financials

-

Cardinal Health: Segmental Revenue

-

Cardinal Health: Geographical Revenue

-

3M: Key Financials

-

3M: Segmental Revenue

-

3M: Geographical Revenue

-

Mölnlycke Health Care: Key Financials

-

Mölnlycke Health Care: Segmental Revenue

-

Mölnlycke Health Care: Geographical Revenue

-

Thermo Fisher Scientific: Key Financials

-

Thermo Fisher Scientific: Segmental Revenue

-

Thermo Fisher Scientific: Geographical Revenue

-

STERIS Corporation: Key Financials

-

STERIS Corporation: Segmental Revenue

-

STERIS Corporation: Geographical Revenue

-

Paul Hartmann AG: Key Financials

-

Paul Hartmann AG: Segmental Revenue

-

Paul Hartmann AG: Geographical Revenue

-

Pacon Manufacturing: Key Financials

-

Pacon Manufacturing: Segmental Revenue

-

Pacon Manufacturing: Geographical Revenue

-

Medica Europe B.V.: Key Financials

-

Medica Europe B.V.: Segmental Revenue

-

Medica Europe B.V.: Geographical Revenue

-

Guardian: Key Financials

-

Guardian: Segmental Revenue

-

Guardian: Geographical Revenue

-

'

Leave a Comment