Expansion of Telehealth Services

The COVID-19 Diagnostics Market is witnessing a notable expansion of telehealth services, which has transformed the way patients access diagnostic testing. Telehealth platforms facilitate remote consultations, allowing healthcare providers to assess symptoms and recommend appropriate diagnostic tests without the need for in-person visits. This shift has been particularly beneficial during periods of heightened health risks, as it minimizes exposure to infectious agents. Data indicates that telehealth usage has increased by over 50% since the onset of the pandemic, reflecting a significant change in patient behavior and healthcare delivery. The integration of telehealth with diagnostic services is likely to continue evolving, as it offers convenience and accessibility, thereby enhancing the overall efficiency of the COVID-19 Diagnostics Market.

Government Initiatives and Funding

The COVID-19 Diagnostics Market benefits from various government initiatives and funding aimed at enhancing diagnostic capabilities. Governments worldwide have recognized the importance of robust testing infrastructure in managing public health crises. As a result, substantial investments have been made to support the development and distribution of diagnostic tests. For instance, funding programs have been established to accelerate the approval of new testing technologies and to ensure their availability in underserved areas. Reports indicate that government funding for diagnostic testing has increased by over 30% in recent years, reflecting a commitment to improving healthcare responses. Such initiatives not only bolster the COVID-19 Diagnostics Market but also contribute to the overall resilience of healthcare systems.

Rising Public Awareness and Education

The COVID-19 Diagnostics Market is experiencing a rise in public awareness and education regarding the importance of diagnostic testing. As communities become more informed about the role of testing in controlling the spread of infectious diseases, there is a growing willingness to participate in testing programs. Educational campaigns have been instrumental in dispelling myths and encouraging proactive health measures, leading to increased testing rates. Data suggests that public participation in testing initiatives has risen by approximately 40% in recent years, highlighting a shift in societal attitudes towards health and safety. This heightened awareness is likely to sustain demand for diagnostic services, thereby positively impacting the COVID-19 Diagnostics Market in the foreseeable future.

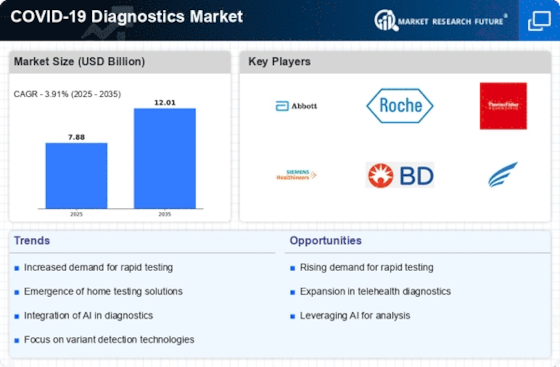

Increased Demand for Rapid Testing Solutions

The COVID-19 Diagnostics Market experiences heightened demand for rapid testing solutions, driven by the need for timely diagnosis and containment of potential outbreaks. As the world continues to navigate the complexities of respiratory illnesses, the preference for tests that deliver results within minutes rather than days has surged. This shift is evidenced by a reported increase in the adoption of antigen tests, which are often favored for their speed and ease of use. The market for rapid tests is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend underscores the critical role that rapid testing plays in public health strategies, as it enables quicker decision-making and enhances the ability to manage healthcare resources effectively.

Emergence of New Variants and Continuous Testing Needs

The COVID-19 Diagnostics Market is significantly influenced by the emergence of new variants of the virus, which necessitates ongoing testing efforts. As variants evolve, the effectiveness of existing diagnostic tests may be challenged, prompting the need for continuous updates and innovations in testing methodologies. This dynamic environment creates a sustained demand for diagnostic solutions that can accurately identify various strains of the virus. Market analysis suggests that the need for variant-specific tests could drive a substantial portion of the market, with projections indicating a potential increase in testing volumes by 20% annually. This ongoing requirement for adaptability in testing underscores the critical importance of research and development within the COVID-19 Diagnostics Market.