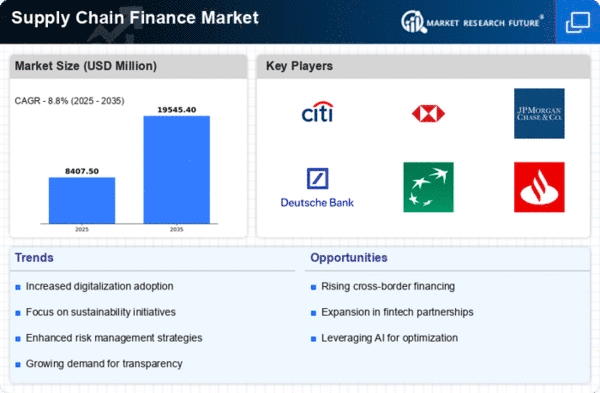

Market Growth Projections

The Global Supply Chain Finance Market Industry is poised for substantial growth, with projections indicating a rise from 104.0 USD Billion in 2024 to 347.5 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 11.59% from 2025 to 2035. Such growth is indicative of the increasing recognition of supply chain finance as a vital component of modern business operations. Companies are likely to invest in innovative financing solutions to enhance their supply chain efficiency and resilience, thereby positioning themselves favorably in an increasingly competitive market.

Globalization of Trade and Commerce

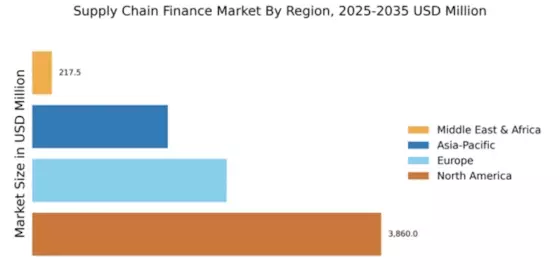

The ongoing globalization of trade and commerce significantly influences the Global Supply Chain Finance Market Industry. As businesses expand their operations across borders, the complexity of supply chains increases, necessitating effective financing solutions. Companies are increasingly reliant on supply chain finance to mitigate risks associated with international transactions. This trend is expected to drive market growth, with a compound annual growth rate of 11.59% anticipated from 2025 to 2035. The ability to manage diverse supplier networks and navigate regulatory environments is crucial for businesses aiming to thrive in a globalized economy.

Focus on Sustainability and Ethical Practices

There is a growing emphasis on sustainability and ethical practices within the Global Supply Chain Finance Market Industry. Companies are increasingly aware of the need to align their financing strategies with environmental and social governance (ESG) criteria. This shift is prompting businesses to seek financing solutions that support sustainable practices, such as green supply chain initiatives. As a result, the market is likely to witness an increase in demand for financing options that prioritize sustainability. This trend not only enhances corporate reputation but also attracts socially conscious investors, further driving market growth.

Regulatory Support and Government Initiatives

Regulatory support and government initiatives play a pivotal role in shaping the Global Supply Chain Finance Market Industry. Governments worldwide are recognizing the importance of supply chain finance in promoting economic stability and growth. Initiatives aimed at enhancing access to financing for small and medium-sized enterprises (SMEs) are particularly noteworthy. These measures contribute to the overall health of the supply chain ecosystem, fostering innovation and competitiveness. As governments continue to implement supportive policies, the market is expected to expand, creating opportunities for businesses to leverage supply chain finance as a strategic tool.

Increasing Demand for Working Capital Solutions

The Global Supply Chain Finance Market Industry experiences a notable surge in demand for working capital solutions. Businesses increasingly seek to optimize cash flow and enhance liquidity, particularly in a competitive landscape. The market is projected to reach 104.0 USD Billion in 2024, reflecting a growing recognition of the importance of efficient financing options. Companies are leveraging supply chain finance to improve supplier relationships and reduce costs. This trend is particularly evident in sectors such as manufacturing and retail, where timely payments can significantly impact operational efficiency and profitability.

Technological Advancements in Financial Services

Technological innovations are transforming the Global Supply Chain Finance Market Industry, facilitating more efficient and transparent financial transactions. The integration of blockchain technology, artificial intelligence, and machine learning enhances risk assessment and credit evaluation processes. These advancements enable real-time monitoring of supply chain activities, thereby improving decision-making capabilities for businesses. As a result, the market is likely to experience substantial growth, with projections indicating a rise to 347.5 USD Billion by 2035. Companies adopting these technologies can streamline operations and reduce financing costs, positioning themselves competitively in the evolving landscape.