Rising Demand for Efficiency

The Supply Chain Analytics Market is experiencing a notable surge in demand for enhanced operational efficiency. Organizations are increasingly recognizing the necessity of optimizing their supply chain processes to reduce costs and improve service levels. According to recent data, companies that implement advanced analytics can achieve up to a 20% reduction in operational costs. This trend is driven by the need to streamline logistics, inventory management, and demand forecasting. As businesses strive to remain competitive, the adoption of analytics tools that provide actionable insights is becoming paramount. The Supply Chain Analytics Market is thus poised for growth as firms seek to leverage data-driven strategies to enhance their overall performance.

Regulatory Compliance and Standards

The Supply Chain Analytics Market is also influenced by the growing need for regulatory compliance and adherence to industry standards. As governments and regulatory bodies implement stricter guidelines regarding supply chain transparency and sustainability, organizations are compelled to adopt analytics solutions that ensure compliance. This trend is particularly evident in industries such as food and pharmaceuticals, where traceability is paramount. Companies that leverage analytics to monitor compliance can enhance their operational integrity and avoid potential penalties. The increasing complexity of regulations is likely to drive investment in supply chain analytics, thereby propelling growth within the Supply Chain Analytics Market.

Growing Importance of Risk Management

Risk management has become a critical focus within the Supply Chain Analytics Market. Organizations are increasingly aware of the vulnerabilities within their supply chains and are seeking analytics solutions to identify and mitigate risks. The ability to predict potential disruptions, such as supplier failures or geopolitical issues, is essential for maintaining operational continuity. Data indicates that companies that proactively manage supply chain risks can reduce their exposure to disruptions by up to 50%. This heightened emphasis on risk management is driving the demand for sophisticated analytics tools that provide real-time insights and scenario planning capabilities, thereby fostering growth in the Supply Chain Analytics Market.

Increased Focus on Data-Driven Decision Making

In the Supply Chain Analytics Market, there is a marked shift towards data-driven decision making. Organizations are increasingly utilizing analytics to inform their strategic choices, which is evident in the growing investment in data analytics technologies. Reports indicate that companies employing data analytics in their supply chain operations can improve their forecasting accuracy by as much as 30%. This trend underscores the importance of harnessing data to gain insights into consumer behavior, market trends, and operational efficiencies. As businesses continue to prioritize data-driven strategies, the Supply Chain Analytics Market is likely to expand, driven by the need for informed decision-making processes.

Emergence of Artificial Intelligence and Machine Learning

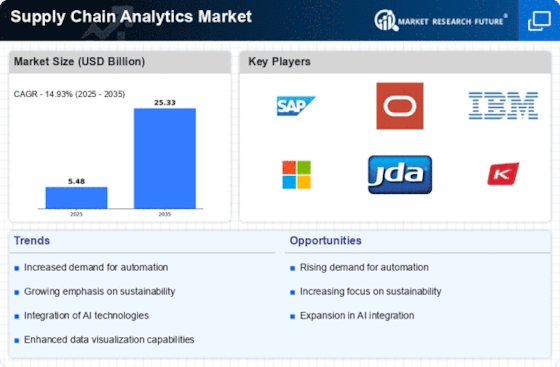

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the Supply Chain Analytics Market. These advanced technologies enable organizations to analyze vast amounts of data quickly and accurately, leading to improved predictive analytics capabilities. The implementation of AI and ML can enhance supply chain visibility and responsiveness, allowing companies to anticipate disruptions and optimize their operations. Current estimates suggest that the adoption of AI in supply chain management could lead to a potential increase in productivity by 40%. As these technologies continue to evolve, the Supply Chain Analytics Market is expected to witness significant advancements and innovations.