Increasing Demand for High-Performance Concrete

The Global Superplasticizers Market Industry experiences a notable surge in demand for high-performance concrete, driven by the construction sector's need for durable and efficient materials. Superplasticizers Market enhance the workability of concrete, allowing for reduced water content while maintaining strength. This trend is particularly evident in urban infrastructure projects, where the demand for sustainable and resilient materials is paramount. As a result, the market is projected to reach 7.26 USD Billion in 2024, reflecting a growing recognition of superplasticizers' benefits in concrete formulations. The increasing focus on green building practices further supports this demand, indicating a robust growth trajectory for the Global Superplasticizers Market Industry.

Technological Advancements in Concrete Additives

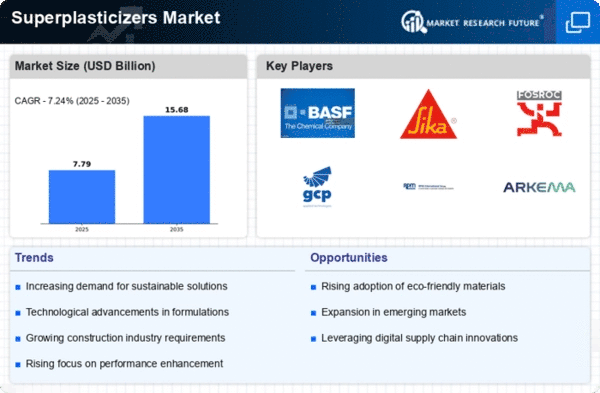

Technological innovations in concrete additives are reshaping the Global Superplasticizers Market Industry. The development of new formulations and improved manufacturing processes enhances the performance characteristics of superplasticizers, making them more effective in various applications. For example, advancements in polymer chemistry have led to the creation of superplasticizers that offer superior water reduction capabilities and enhanced durability. These innovations not only meet the evolving demands of the construction industry but also contribute to the overall growth of the market. As these technologies continue to evolve, the Global Superplasticizers Market Industry is poised for sustained growth, with a projected CAGR of 7.25% from 2025 to 2035.

Rising Urbanization and Infrastructure Development

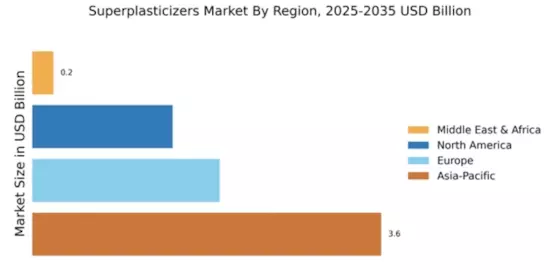

The rapid pace of urbanization and infrastructure development globally serves as a key driver for the Global Superplasticizers Market Industry. As cities expand and populations increase, the demand for robust infrastructure, including roads, bridges, and buildings, intensifies. Superplasticizers Market play a crucial role in meeting these demands by improving the workability and performance of concrete, thereby facilitating faster construction processes. This trend is particularly pronounced in emerging economies, where significant investments in infrastructure are underway. The growing urban landscape is expected to propel the market forward, contributing to its anticipated growth trajectory and reinforcing the importance of superplasticizers in modern construction.

Government Initiatives for Sustainable Construction

Government policies promoting sustainable construction practices significantly influence the Global Superplasticizers Market Industry. Various countries are implementing regulations that encourage the use of eco-friendly materials, including superplasticizers, to reduce the carbon footprint of construction activities. For instance, initiatives aimed at enhancing energy efficiency in buildings often highlight the role of superplasticizers in producing high-performance concrete. These policies not only stimulate market growth but also align with global sustainability goals. As the industry adapts to these regulations, the market is expected to expand, potentially reaching 15.7 USD Billion by 2035, underscoring the importance of government support in driving the adoption of superplasticizers.

Chart: Global Superplasticizers Market Growth Projections

This chart illustrates the projected growth of the Global Superplasticizers Market Industry, highlighting key milestones such as the expected market value of 7.26 USD Billion in 2024 and a potential increase to 15.7 USD Billion by 2035. The chart also indicates a CAGR of 7.25% for the period from 2025 to 2035, reflecting the anticipated expansion driven by various market dynamics.