Market Trends

Key Emerging Trends in the Substation Automation Market

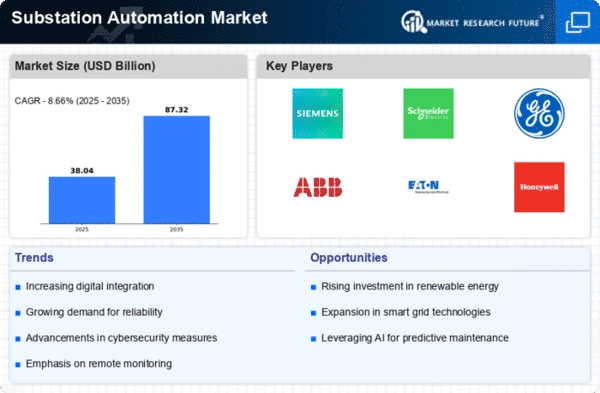

The Substation Automation Market has been experiencing significant growth and evolving trends, reflecting the ongoing transformation in the power distribution and management sector. As industries and societies strive for increased efficiency, reliability, and sustainability in their energy infrastructure, the demand for advanced substation automation solutions has surged. One notable trend in this market is the increasing adoption of smart grid technologies. Utilities are progressively integrating intelligent electronic devices (IEDs), communication networks, and advanced control systems to enhance the overall performance and monitoring capabilities of substations.

Another key market trend is the rising prominence of digital substations. Traditional substations are transitioning towards digital alternatives, leveraging technologies like digital relays, intelligent electronic devices (IEDs), and communication networks based on protocols like IEC 61850. This shift not only enhances the operational efficiency of substations but also facilitates real-time monitoring, control, and communication, enabling utilities to respond swiftly to changing grid conditions. The digitalization of substations is driven by the need for improved reliability, reduced maintenance costs, and enhanced interoperability between various devices and systems.

Furthermore, the Substation Automation Market is witnessing a growing focus on cybersecurity. With the increasing connectivity of substation devices and communication networks, there is a heightened concern about the vulnerability of these systems to cyber threats. As a result, there is a rising emphasis on implementing robust cybersecurity measures to safeguard critical infrastructure. This involves the deployment of secure communication protocols, intrusion detection systems, and regular cybersecurity audits to identify and address potential vulnerabilities.

Interoperability is another pivotal trend in the Substation Automation Market. As utilities deploy diverse devices from different manufacturers, ensuring seamless communication and integration between these devices becomes crucial. The adoption of standardized communication protocols, such as IEC 61850, plays a pivotal role in achieving interoperability. This standardization allows different devices and systems to communicate effectively, promoting a more cohesive and integrated substation automation ecosystem.

Leave a Comment