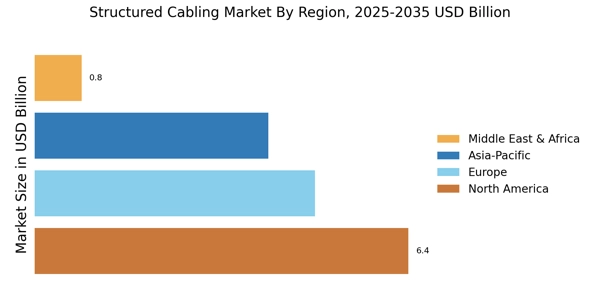

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The North American structured cabling market area will dominate this market. The presence of several key players in North America is one of the key driving factors for the growth of the North American Structured Cabling Market. The growth of the North America structured cabling market is further bolstered by the rapid expansion of hyperscale cloud clusters in regional tech hubs, necessitating advanced Category 6A and fiber backbones. Apart from the US, the Canada structured cabling market is experiencing a surge in demand driven by the development of intelligent building solutions that enhance energy efficiency and occupant comfort in urban centers.

In the Italy structured cabling market, there is a notable surge in demand for integrated smart building solutions, particularly in the restoration and modernization of historic commercial districts in Milan and Rome. The Spain structured cabling market is another rapidly expanding as the country establishes itself as a primary digital hub for Southern Europe, attracting significant investment in AI-ready data centers..

On the other hand, Europe Structured Cabling Market is expected to grow at a moderate CAGR due to the leading players' rising cloud infrastructure and data center-related investment. In addition, the European Union is investing in smart city projects and developing advanced communication infrastructure in countries such as Italy, Sweden, Germany, the United Kingdom, and the Netherlands. Further, the German Structured Cabling Market held the largest market share, and the UK Structured Cabling Market was the fastest-growing market in the European region.

The Asia-Pacific Structured Cabling Market is expected to grow at the fastest CAGR from 2023 to 2030. This is because government initiatives to promote digitization, advanced infrastructure, rising population, accelerated adoption of smart devices, and investments in cloud and IoT technologies are expected to drive regional market growth. The APAC region is led by developing economies such as China and Japan. Within the China structured cabling market, domestic manufacturers are increasingly integrating AI-driven cable management software to improve the operational efficiency of large-scale smart city projects. The increased use of the Internet in these countries is leading to an increase in the number of broadcast activities. This, in turn, is expected to drive the regional market over the forecast period.

Further, the India Structured Cabling Market held the largest market share, and the China Structured Cabling Market was the fastest-growing market in this region.