Research Methodology on Stretch and Shrink Films Market

INTRODUCTION

Stretch and shrink films are primarily used to secure and ensure complete protection of the goods while they are stored, handled and transported. Generally, outside packages contain several items kept inside a wrap. For this application, stretch and shrink films are appropriate and enable complete coverage of the packed objects. In recent times, stretch and shrink films are being widely employed for heavy packaging applications, due to their easy and proficient way of wrapping and safe handling.

AIM & OBJECTIVE

This research aims to analyze the growing global Stretch and Shrink Film market. The scope of the research is to gain insight into the market and provide an accurate forecast focusing on the market dynamics, market trends and major players in the global Stretch and Shrink Film market.

The objectives of the research are to-

- Identify and analyze the market dynamics, trends and major players in the global Stretch and Shrink Film market.

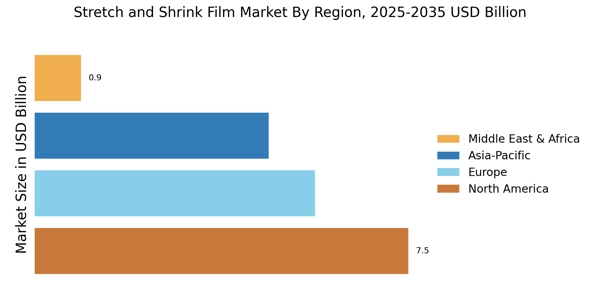

- Analyze the overall market size of the global Stretch and Shrink Film market.

- Analyze the segmentation of the global Stretch and Shrink Film market and forecast the market size of the segment.

- Assess the competitive landscape of the global Stretch and Shrink Film market and understand the key strategies adopted by the major players.

RESEARCH METHODOLOGY

The research approach taken for the research is a combination of quantitative and qualitative approaches. The research uses primary and secondary sources for data collection.

Primary Research

The primary research is conducted via surveys and interviews with industry professionals, vendors, market participants and consumers. Interviews are held with a variety of stakeholders such as industry experts, market researchers, end-users, opinion leaders, consulting firms, etc. These interviews provide data on their opinions, costs, pricing strategies, market trends, customer preferences and other related topics.

In addition, this research also conducts an in-depth analysis and comparison of various products and services of the Stretch and Shrink Film market including but not limited to pricing and cost structures, technological innovations and product offerings.

Secondary Research

The secondary research is conducted via industry reports, company websites, and other published material. The secondary research will provide an overview of the Stretch and Shrink Film market and its competitive landscape, as well as an insight into the strategic development of the market. The focus here is to provide an overview of the market, based on published data and opinions from major players in the particular industry.

Data Sources

The data sources used for the research include both primary and secondary sources. Primary sources include industry reports, company websites, and market research reports. Secondary sources include industry databases and journals, trade magazines and developing news about the style and marketing of the Stretch and Shrink Film market.

Data Analysis

The data analysis involves the analysis of primary and secondary data to develop meaningful insights regarding the market. The research includes a qualitative and quantitative analysis of the market size and forecast. The data is analyzed using statistical techniques such as forecasting, regression analysis, regression models, and economic models.

Market Estimation

The market estimation is conducted using the market forecast method. This method incorporates various factors such as market size, market trends, competitive environment, and macroeconomic factors. The market estimation is conducted using historical data, present market data and future projections. The forecasts are validated using industry data and consensus estimates.

Sampling Frame

The sampling frame used for the research includes industry experts, market participants, vendors and consumers. The sampling frame is selected based on the area of interest or geographic region.