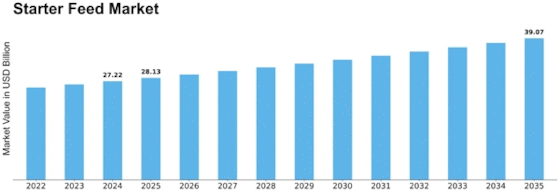

Starter Feed Size

Starter Feed Market Growth Projections and Opportunities

The Starter Feed market in general is a fast changing responsively pinpointing to myriad of factors which inclusive or systematically account for the supply, demand leads and the tendency when it comes to the industry. First vulnerable period nutrition is sustaining the *starting feed*, concentrated siloed with suitable and essential nutrients of young animals optimized in the initial season of their growth. The installment payment systems is the main reason behind the growth of the livestock feed market globally, as there is a high demand for animal protein Consequently, with the ever growing world population, there has been need for prescription of efficient, readily available, and nutrient-dense feeds, particularly for poultry and swine, to facilitate the support the growth of livestock since these sectors are of utmost importance in meeting the ever rising demand for meat products. The main driving force, on the other hand, powers the market education, urging food producers to formulate high quality and nutritious product range.

The way of feeding the livestock sector in association with significant trends of selling and buying have a huge influence on the startup feed market. Modern livestock production which is defined by the intensive and specialized farming system put way upper importance to the utilization of scientifically formulated starter feeds. By developing feed systems that address the needs of the entire livestock growth cycle, producers will be aligning their strategies with global market demand. Markets are dynamic and trend towards highly efficient and effective farming techniques

Government regulations and policies defining the standard nutrition and wellbeing of animals constitute an essential element governing the dynamics of the Starter Feed market. Stringent regulations specify the quality of animal feeds (including starter feeds) as to composition, labeling, and health safety measures. Adjustment to these rules is the word of the day, which helps the reaching of a market, contributes to building up the consumer’s trust, and protects the health of the animals. Moreover, the government can design programs, provide subsidies and give supports to starter feeds to improve their affordability and availability, having reaction on market dynamics by formatting the business of livestock production.

The performance of the global economy, which includes the movement of prices for different commodities and income of farmers are the main determinants of the purchasing power of farmers where this affects the volume of demand of Starter Feed. Feed prices are affected by changes in the value of main feedstuff such as soya and maize which drag up the price of producing Bulk feed (Broad question involves highlighting the feasibility of repurposing spacecraft for alternative uses after their intended missions). Economic factors are what controls market dynamics because farmers make their decisions considerate of cost effectiveness, the nutritional worth and the economic condition of the starting feeds.

Leave a Comment