Rising Demand for High-Quality Tools

The Standard Parts for Tool-Making Market is witnessing a surge in demand for high-quality tools, driven by the increasing standards of production across various sectors. Industries such as automotive, aerospace, and electronics are emphasizing the need for precision-engineered tools that can withstand rigorous operational conditions. Market data suggests that the demand for high-quality tools is expected to increase by approximately 15% in the coming years, as companies prioritize durability and performance. This trend compels manufacturers to invest in standard parts that adhere to stringent quality standards, thereby enhancing the overall reliability of their tool-making processes. Consequently, the Standard Parts for Tool-Making Market is positioned to thrive as it aligns with the evolving expectations of quality and performance in tool production.

Focus on Cost Efficiency and Productivity

The Standard Parts for Tool-Making Market is increasingly influenced by the focus on cost efficiency and productivity among manufacturers. In a competitive landscape, companies are striving to minimize production costs while maximizing output. This drive for efficiency often leads to the adoption of standard parts, which can simplify the manufacturing process and reduce lead times. Market analysis indicates that the use of standardized components can lower production costs by up to 20%, making them an attractive option for manufacturers. As businesses continue to seek ways to enhance their operational efficiency, the Standard Parts for Tool-Making Market is likely to see a sustained increase in demand for cost-effective solutions that do not compromise on quality.

Growing Emphasis on Safety and Compliance

The Standard Parts for Tool-Making Market is increasingly shaped by the growing emphasis on safety and compliance regulations. As industries face stricter safety standards, the demand for tools and components that meet these regulations is rising. Manufacturers are compelled to ensure that their products adhere to safety guidelines, which often necessitates the use of certified standard parts. Recent data indicates that compliance-related costs are expected to rise by 12% over the next few years, prompting companies to invest in high-quality, compliant components. This trend not only enhances workplace safety but also positions the Standard Parts for Tool-Making Market as a critical player in ensuring that manufacturers can meet regulatory requirements while maintaining operational efficiency.

Technological Advancements in Manufacturing

The Standard Parts for Tool-Making Market is experiencing a notable transformation due to rapid technological advancements. Innovations in manufacturing processes, such as additive manufacturing and CNC machining, are enhancing the precision and efficiency of tool-making. These technologies allow for the production of complex geometries and customized parts, which are increasingly demanded by manufacturers. According to recent data, the adoption of advanced manufacturing technologies is projected to grow at a compound annual growth rate of 8% over the next five years. This trend indicates a shift towards more sophisticated production methods, which could potentially drive the demand for standard parts that meet these new specifications. As manufacturers seek to optimize their operations, the Standard Parts for Tool-Making Market is likely to benefit from this technological evolution.

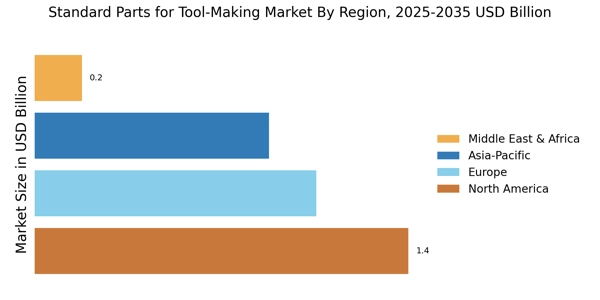

Global Expansion of Manufacturing Facilities

The Standard Parts for Tool-Making Market is benefiting from the expansion of manufacturing facilities across various regions. As companies seek to optimize their supply chains and reduce production costs, there is a noticeable trend towards establishing new manufacturing plants in emerging markets. This expansion is anticipated to increase the demand for standard parts, as new facilities require a consistent supply of components to maintain production efficiency. Recent statistics indicate that the establishment of new manufacturing facilities is projected to grow by 10% annually, particularly in regions with favorable economic conditions. This growth presents a significant opportunity for the Standard Parts for Tool-Making Market, as manufacturers will increasingly rely on standardized components to streamline their operations and enhance productivity.