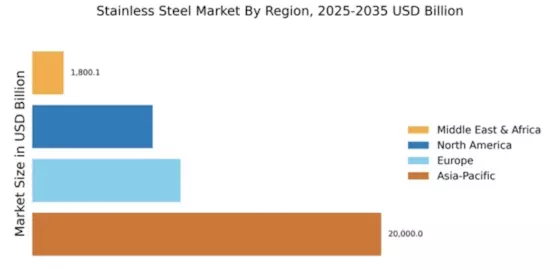

Market Growth Projections

The Global Stainless Steel Market Industry is poised for substantial growth, with projections indicating a market value of 109.6 USD Billion in 2024 and an anticipated increase to 150 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 2.89% from 2025 to 2035, reflecting the material's expanding applications across various sectors. The increasing demand for stainless steel in construction, automotive, and renewable energy sectors, coupled with advancements in production technologies, underpins this optimistic outlook. Such projections highlight the material's critical role in future industrial developments.

Increased Focus on Sustainability

The Global Stainless Steel Market Industry is witnessing a shift towards sustainability, as both consumers and manufacturers prioritize eco-friendly practices. Stainless steel is inherently recyclable, which enhances its appeal in a market increasingly concerned with environmental impact. This focus on sustainability is prompting manufacturers to adopt greener production methods and promote the recyclability of stainless steel products. As a result, the market is likely to benefit from heightened consumer awareness and regulatory support for sustainable materials. This trend could further bolster the industry's growth trajectory, contributing to the projected market value increase to 150 USD Billion by 2035.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector significantly influences the Global Stainless Steel Market Industry. Stainless steel is increasingly utilized in the manufacturing of wind turbines and solar panels due to its strength and resistance to harsh environmental conditions. As countries invest in sustainable energy solutions, the demand for stainless steel components is expected to rise. This trend aligns with global efforts to transition to cleaner energy sources, potentially driving the market value to 150 USD Billion by 2035. The renewable energy sector's growth underscores the material's versatility and importance in modern energy infrastructure.

Rising Demand from Construction Sector

The Global Stainless Steel Market Industry experiences a robust demand surge from the construction sector, driven by the material's durability and aesthetic appeal. As urbanization accelerates, particularly in developing regions, the need for stainless steel in structural applications is expected to grow. In 2024, the market value is projected to reach 109.6 USD Billion, with significant contributions from architectural designs that favor stainless steel for its corrosion resistance and low maintenance. This trend indicates a potential for sustained growth, as the construction industry increasingly adopts stainless steel for both functional and decorative purposes.

Technological Advancements in Production

Technological innovations in the production processes of stainless steel are reshaping the Global Stainless Steel Industry. Enhanced manufacturing techniques, such as electric arc furnaces and advanced refining methods, lead to improved efficiency and reduced costs. These advancements not only optimize resource utilization but also minimize environmental impact, aligning with global sustainability goals. As a result, manufacturers are likely to increase their output, contributing to the projected market growth from 109.6 USD Billion in 2024 to 150 USD Billion by 2035. This evolution in production technology could significantly alter competitive dynamics within the industry.

Growing Applications in Automotive Industry

The automotive sector's increasing reliance on stainless steel for vehicle manufacturing is a notable driver of the Global Stainless Steel. Stainless steel's lightweight and corrosion-resistant properties make it an ideal choice for various automotive components, including exhaust systems and structural parts. As automotive manufacturers strive to enhance fuel efficiency and reduce emissions, the demand for stainless steel is likely to rise. This trend could contribute to a compound annual growth rate of 2.89% from 2025 to 2035, reflecting the material's integral role in the future of automotive design and production.