Growing Demand in Energy Sector

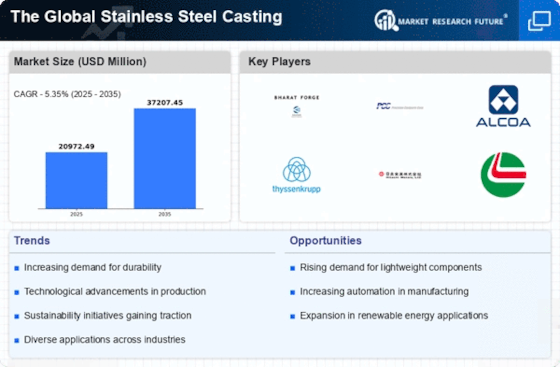

The energy sector is witnessing a growing demand for stainless steel castings, particularly in renewable energy applications. Components used in wind turbines, solar panels, and hydroelectric systems require materials that can withstand harsh environmental conditions. The Global Stainless Steel Casting Industry is expected to benefit from this trend, with projections indicating a compound annual growth rate of 7% in the energy sector by 2025. This growth is fueled by the global shift towards sustainable energy solutions and the need for reliable, long-lasting materials. As investments in renewable energy infrastructure increase, the demand for stainless steel castings is likely to rise, positioning the industry for substantial growth.

Increased Focus on Sustainability

There is an increased focus on sustainability within The Global Stainless Steel Casting Industry, as manufacturers and consumers alike prioritize environmentally friendly practices. Stainless steel is inherently recyclable, which aligns with the growing demand for sustainable materials in various applications. In 2025, the market is projected to see a rise in the use of recycled stainless steel in casting processes, potentially increasing the market share of sustainable products by 15%. This shift is driven by regulatory pressures and consumer preferences for eco-friendly products. As companies adopt sustainable practices, the demand for stainless steel castings that meet these criteria is likely to grow, further enhancing the industry's market potential.

Rising Demand from Automotive Sector

The automotive sector is experiencing a notable increase in demand for stainless steel castings, driven by the need for lightweight and durable materials. Stainless steel castings are favored for their corrosion resistance and strength, making them ideal for various automotive components. In 2025, the automotive industry is projected to account for a significant share of The Global Stainless Steel Casting Industry, with estimates suggesting a growth rate of approximately 5% annually. This trend is likely to continue as manufacturers seek to enhance vehicle performance and fuel efficiency, thereby propelling the demand for stainless steel castings. Furthermore, the shift towards electric vehicles is expected to further augment this demand, as these vehicles require advanced materials to meet stringent safety and performance standards.

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are contributing to the expansion of The Global Stainless Steel Casting Industry. Governments are investing heavily in infrastructure projects, including bridges, railways, and buildings, which require high-quality materials. Stainless steel castings are increasingly utilized in construction due to their durability and resistance to environmental factors. In 2025, the market for stainless steel castings in the construction sector is anticipated to grow at a rate of around 6%, reflecting the ongoing urbanization and the need for sustainable building solutions. This growth is further supported by the rising focus on green building practices, which favor materials that offer longevity and reduced maintenance costs.

Technological Innovations in Casting Processes

Technological innovations in casting processes are reshaping the landscape of The Global Stainless Steel Casting Industry. Advancements such as 3D printing and precision casting techniques are enhancing the efficiency and quality of stainless steel castings. These innovations allow for the production of complex geometries and reduce material waste, which is increasingly important in a competitive market. In 2025, it is estimated that the adoption of these technologies could lead to a 10% reduction in production costs for manufacturers. As companies strive to improve their operational efficiency and product offerings, the integration of advanced technologies is likely to drive growth in the stainless steel casting sector.