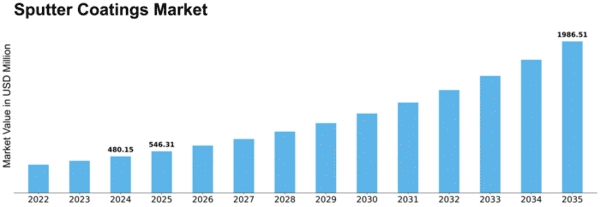

Sputter Coatings Size

Sputter Coatings Market Growth Projections and Opportunities

The Sputter Coatings market is driven by various factors that determine how it behaves. One of them is the increasing demand for thin film deposition in different industries. In fact, sputter coatings are being applied in electronics and other industries like automotive and aerospace because they are best for depositing thin films on different types of substrates. This has pushed the industry into making more advanced materials with improved properties including durability and conductivity among others. The global sputter coatings market was estimated at USD 4.9 billion in 2018, growing at a CAGR of 5.1% during the forecast period, 2019–2025.

In addition to this, market growth can be attributed to advancements that have been made in technology used for Sputtering coating. As manufacturers try to develop better products through continuous research aimed at improving the precision and efficiency of sputtering processes, the sector has become innovative. This has resulted in an increase in the number of companies providing coatings that perform better than their predecessors do enabling end users to easily adapt to changeable needs. Thus, while stimulating market growth, this promotes competition.

Economic factors such as investment in research and development, overall industrial growth and consumer spending influence where the market will go next. With favorable economic conditions comes increased investment in technology and innovation within the sputter coatings industry. On the contrary, economic downturns or uncertainties may lead to fluctuations as organizations may cut down on capital expenditures.

Additionally, another crucial determinant is stiff competition amongst major players within this space which shapes its behavior over time. Companies continuously seek ways to make their products stand out from those offered by competitors so as not only to stay ahead but also beat them sometimes through product innovations strategic collaborations mergers and acquisitions where necessary . Competition over cost leadership quality/ecological excellence or technological advancement creates a dynamic environment that provides end users with numerous alternatives thereby enhancing performance.

To sum up, the growth and development of Sputter Coatings market are affected by multiple parameters. The demand for thin film deposition, technological developments, environmental considerations, regional industrial activities, economic aspects and competitive forces all form part of the larger canvas for this industry. As companies look to achieve more sustainable solutions through advanced materials development, the Sputter Coatings market is poised for long-term growth and innovation.

Leave a Comment