Increasing Healthcare Expenditure

The rise in healthcare expenditure across various regions is significantly influencing the Spinal Implants Market. Governments and private sectors are allocating more resources to healthcare, which includes funding for advanced surgical procedures and spinal implant technologies. For instance, healthcare spending in certain regions has seen an increase of over 10% annually, reflecting a commitment to improving patient care. This financial support enables hospitals and clinics to adopt the latest spinal implant technologies, thereby enhancing treatment options for patients with spinal disorders. As healthcare expenditure continues to rise, the Spinal Implants Market is poised for sustained growth, driven by increased accessibility to innovative treatment solutions.

Growing Awareness of Spinal Health

There is a notable increase in awareness regarding spinal health and the importance of early intervention, which is positively impacting the Spinal Implants Market. Educational campaigns and initiatives by healthcare organizations are informing the public about spinal disorders and available treatment options. This heightened awareness is leading to more individuals seeking medical advice and treatment for spinal issues, thereby increasing the demand for spinal implants. Additionally, as patients become more informed about their treatment choices, they are more likely to opt for advanced surgical solutions, further driving the market. The trend of prioritizing spinal health is expected to continue, contributing to the growth of the Spinal Implants Market.

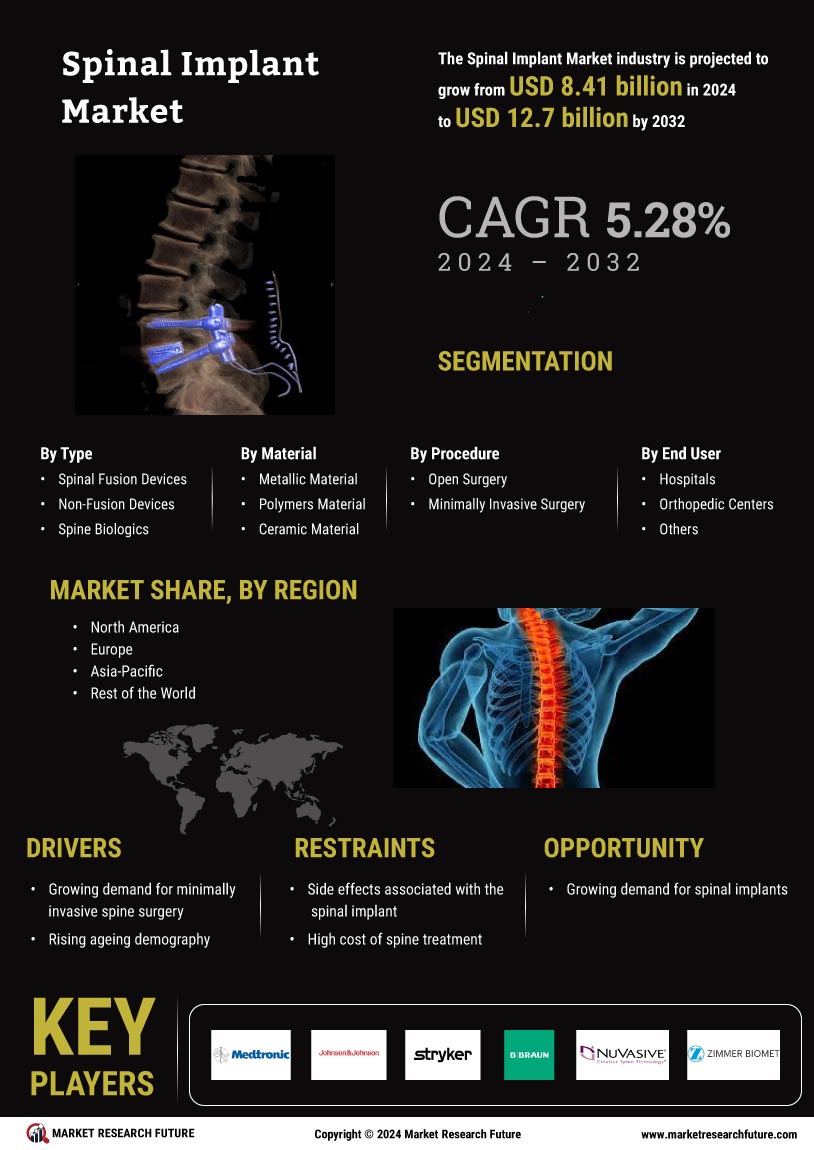

Rising Incidence of Spinal Disorders

The increasing prevalence of spinal disorders, such as degenerative disc disease and spinal stenosis, is a primary driver of the Spinal Implants Market. According to recent data, approximately 80% of adults experience back pain at some point in their lives, leading to a surge in demand for spinal implants. This trend is further exacerbated by an aging population, as older individuals are more susceptible to spinal issues. The need for effective treatment options has prompted healthcare providers to invest in advanced spinal implant technologies, thereby propelling market growth. As the population continues to age, the Spinal Implants Market is expected to expand significantly, with projections indicating a compound annual growth rate of over 5% in the coming years.

Technological Innovations in Implant Design

Technological advancements in implant design are revolutionizing the Spinal Implants Market. Innovations such as 3D printing and bioresorbable materials are enhancing the efficacy and safety of spinal implants. These technologies allow for the creation of customized implants tailored to individual patient anatomies, which may lead to improved surgical outcomes. Furthermore, the integration of smart technologies, such as sensors within implants, is emerging as a trend that could provide real-time data on patient recovery. As these innovations continue to evolve, they are likely to attract investment and drive competition within the Spinal Implants Market, fostering an environment conducive to growth and development.

Rising Demand for Minimally Invasive Surgeries

The growing preference for minimally invasive surgical techniques is a significant driver of the Spinal Implants Market. Patients increasingly favor procedures that promise reduced recovery times and lower risk of complications. Minimally invasive surgeries, which often utilize advanced spinal implants, are becoming more common as surgeons adopt these techniques to enhance patient outcomes. Data suggests that minimally invasive spinal surgeries can reduce hospital stays by up to 50%, making them an attractive option for both patients and healthcare providers. As the demand for such procedures continues to rise, the Spinal Implants Market is likely to experience robust growth, fueled by innovations that support these surgical methods.