Increased Regulatory Compliance

In the Spend Analytics Market, the growing emphasis on regulatory compliance is a significant driver. Organizations are increasingly required to adhere to various regulations and standards, which necessitates a comprehensive understanding of their spending activities. Spend analytics tools enable companies to track and report expenditures accurately, ensuring compliance with financial regulations. For instance, industries such as healthcare and finance face stringent compliance requirements, making spend analytics essential for risk management. The market for spend analytics is projected to grow as organizations invest in solutions that facilitate compliance and mitigate potential penalties. Furthermore, the ability to provide transparent reporting and audit trails enhances trust with stakeholders, thereby reinforcing the importance of spend analytics in maintaining regulatory compliance.

Adoption of Cloud-Based Solutions

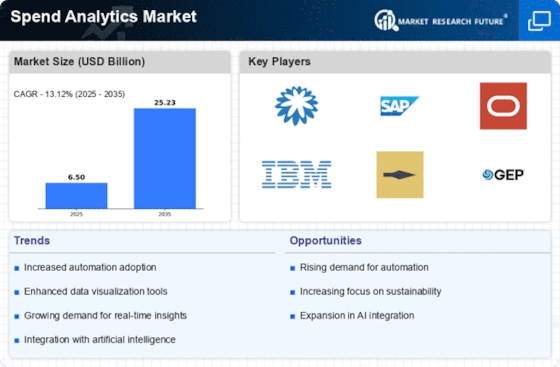

The transition towards cloud-based solutions is reshaping the Spend Analytics Market. Organizations are increasingly adopting cloud technologies to enhance their spend analytics capabilities. Cloud-based solutions offer scalability, flexibility, and cost-effectiveness, allowing businesses to access advanced analytics tools without significant upfront investments. Recent studies indicate that the cloud-based spend analytics segment is expected to witness a compound annual growth rate of over 25% in the coming years. This shift is driven by the need for real-time data access and collaboration among teams, enabling organizations to make data-driven decisions swiftly. As more companies recognize the advantages of cloud technology, the Spend Analytics Market is likely to expand, driven by the demand for innovative and accessible analytics solutions.

Rising Demand for Cost Efficiency

The Spend Analytics Market is experiencing a notable surge in demand for cost efficiency among organizations. As businesses strive to optimize their expenditures, the need for sophisticated spend analytics solutions becomes increasingly apparent. According to recent data, organizations that implement spend analytics can achieve cost reductions of up to 20%. This trend is driven by the necessity to enhance financial performance and streamline procurement processes. Companies are leveraging spend analytics to identify spending patterns, uncover savings opportunities, and negotiate better contracts with suppliers. The ability to analyze spending data in real-time allows organizations to make informed decisions, thereby improving their overall financial health. Consequently, the rising demand for cost efficiency is a pivotal driver in the Spend Analytics Market, as firms seek to maximize their return on investment.

Growing Focus on Supplier Relationship Management

In the Spend Analytics Market, the increasing focus on supplier relationship management (SRM) is emerging as a crucial driver. Organizations are recognizing the importance of maintaining strong relationships with suppliers to enhance procurement efficiency and drive value. Spend analytics tools facilitate the analysis of supplier performance, enabling companies to identify opportunities for collaboration and improvement. By leveraging spend analytics, organizations can assess supplier risks, negotiate better terms, and optimize their supply chains. The market for spend analytics is expected to grow as businesses prioritize SRM strategies, with an emphasis on data-driven decision-making. This trend highlights the role of spend analytics in fostering strategic partnerships and enhancing overall procurement effectiveness.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the Spend Analytics Market. These advanced technologies enable organizations to analyze vast amounts of spending data with greater accuracy and speed. AI and ML algorithms can identify patterns and trends that may not be immediately apparent, providing valuable insights for decision-makers. The adoption of AI-driven spend analytics solutions is projected to increase as organizations seek to enhance their analytical capabilities. This trend is likely to lead to more predictive analytics, allowing businesses to forecast spending behaviors and optimize their procurement strategies. As AI and ML continue to evolve, their impact on the Spend Analytics Market will likely be profound, driving innovation and efficiency in spend management.