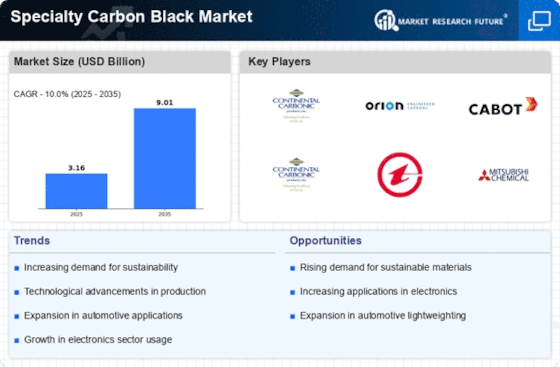

Rising Focus on Sustainable Practices

Sustainability initiatives are becoming a pivotal driver for the Specialty Carbon Black Market. As industries strive to reduce their carbon footprint, there is a growing demand for eco-friendly alternatives to traditional carbon black. Manufacturers are increasingly exploring bio-based carbon black and other sustainable materials to meet regulatory requirements and consumer preferences. In 2025, the market is likely to witness a shift towards sustainable production processes, which may include the use of renewable feedstocks and energy-efficient manufacturing techniques. This transition not only aligns with global sustainability goals but also presents opportunities for innovation within the specialty carbon black sector, potentially leading to the development of new products that cater to environmentally conscious consumers.

Increasing Demand from Automotive Sector

The automotive sector is a primary driver for the Specialty Carbon Black Market, as manufacturers increasingly utilize specialty carbon black in tires and other components. The demand for high-performance tires, which require specific grades of carbon black for enhanced durability and performance, is on the rise. In 2025, the automotive industry is projected to account for a substantial share of the specialty carbon black consumption, driven by the growing emphasis on fuel efficiency and safety. Furthermore, the shift towards electric vehicles is likely to create new opportunities for specialty carbon black applications, as these vehicles require advanced materials to meet performance standards. This trend indicates a robust growth trajectory for the specialty carbon black market, particularly in regions with a strong automotive manufacturing base.

Technological Innovations in Production Processes

Technological advancements in production processes are significantly influencing the Specialty Carbon Black Market. Innovations such as advanced manufacturing techniques and improved quality control measures are enhancing the efficiency and consistency of specialty carbon black production. In 2025, the market is expected to benefit from these technological improvements, which may lead to reduced production costs and enhanced product performance. Furthermore, the integration of automation and digital technologies in manufacturing processes is likely to streamline operations, allowing for greater flexibility in meeting customer demands. This trend indicates that companies investing in technology are well-positioned to capture a larger share of the specialty carbon black market, as they can offer superior products that meet evolving industry standards.

Expansion in Electronics and Electrical Applications

The Specialty Carbon Black Market is experiencing notable growth due to its expanding applications in the electronics and electrical sectors. Specialty carbon black is utilized in conductive plastics, coatings, and other materials that require electrical conductivity. As the demand for electronic devices continues to surge, the need for high-quality conductive materials is becoming increasingly critical. In 2025, the electronics sector is expected to contribute significantly to the overall demand for specialty carbon black, particularly in applications such as smartphones, tablets, and other consumer electronics. This trend suggests that manufacturers are likely to invest in innovative formulations of specialty carbon black to enhance performance characteristics, thereby driving market growth.

Growth in Construction and Infrastructure Development

The Specialty Carbon Black Market is poised for growth due to the increasing demand from the construction and infrastructure sectors. Specialty carbon black is utilized in various applications, including coatings, sealants, and asphalt, which are essential for construction projects. As urbanization continues to accelerate, the need for durable and high-performance materials is becoming more pronounced. In 2025, the construction sector is anticipated to drive a significant portion of the demand for specialty carbon black, particularly in regions experiencing rapid infrastructure development. This trend suggests that manufacturers may need to adapt their product offerings to cater to the specific requirements of the construction industry, thereby fostering further growth in the specialty carbon black market.