Government Initiatives and Policies

The smart grid market in Spain is significantly influenced by government initiatives. These initiatives aim to enhance energy efficiency and sustainability. The Spanish government has implemented various policies to promote the adoption of smart grid technologies, including financial incentives and regulatory frameworks. For instance, the National Integrated Energy and Climate Plan (PNIEC) outlines ambitious targets for renewable energy integration and grid modernization. This plan aims to achieve a 74% reduction in greenhouse gas emissions by 2030, which necessitates the deployment of smart grid solutions. Furthermore, the government has allocated approximately €1.5 billion for smart grid projects, indicating a strong commitment to transforming the energy landscape. These initiatives not only foster innovation but also create a conducive environment for investments in the smart grid market, thereby driving its growth in Spain.

Rising Energy Demand and Urbanization

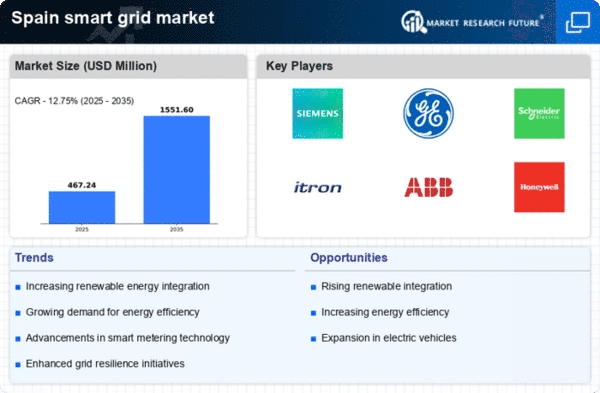

The increasing energy demand driven by urbanization is a crucial factor influencing the smart grid market in Spain. As urban areas expand, the need for efficient energy management becomes paramount. The Spanish population is projected to reach approximately 50 million by 2030, leading to a surge in energy consumption. This rising demand necessitates the modernization of existing grid infrastructure to accommodate new energy sources and improve reliability. The smart grid market is projected to grow at a CAGR of around 10% over the next five years, largely due to this urbanization trend. Additionally, the integration of smart grid technologies can help mitigate the challenges posed by peak demand periods, ensuring a stable energy supply. Consequently, The smart grid market is projected to experience robust growth as cities adapt to the evolving energy landscape.

Investment in Infrastructure Modernization

Investment in infrastructure modernization is a key driver of the smart grid market in Spain. The aging energy infrastructure poses challenges in terms of efficiency and reliability. This situation prompts the need for significant upgrades. The Spanish government, along with private sector stakeholders, is investing heavily in modernizing the grid to incorporate smart technologies. Recent reports indicate that investments in smart grid infrastructure could exceed €3 billion by 2027. This modernization effort aims to enhance grid resilience, reduce transmission losses, and facilitate the integration of renewable energy sources. Furthermore, the adoption of smart grid technologies is expected to create thousands of jobs in the energy sector, contributing to economic growth. As such, the focus on infrastructure investment is likely to propel the smart grid market forward, ensuring a sustainable energy future for Spain.

Technological Advancements in Communication

Technological advancements in communication technologies are playing a pivotal role in shaping the smart grid market in Spain. The integration of advanced communication systems, such as Internet of Things (IoT) and 5G networks, enhances the efficiency and reliability of energy distribution. These technologies facilitate real-time data exchange between utilities and consumers, enabling better demand management and grid optimization. According to recent estimates, the adoption of IoT in the energy sector could lead to a reduction in operational costs by up to 20%. Moreover, the deployment of smart meters, which are essential for the functioning of smart grids, is expected to reach 30 million units by 2025 in Spain. This proliferation of communication technologies not only improves grid resilience but also empowers consumers to make informed energy choices, thus propelling the smart grid market forward.

Consumer Awareness and Sustainability Trends

Consumer awareness regarding sustainability and energy efficiency is increasingly shaping the smart grid market in Spain. As individuals become more conscious of their environmental impact, there is a growing demand for sustainable energy solutions. This trend is reflected in the rising popularity of energy-efficient appliances and renewable energy sources among consumers. Surveys indicate that over 60% of Spanish consumers are willing to invest in smart home technologies that promote energy savings. Additionally, the shift towards sustainability is prompting utilities to adopt smart grid technologies that enable better energy management and consumer engagement. The smart grid market is likely to benefit from this heightened consumer interest, as utilities strive to meet the expectations of environmentally conscious customers. Consequently, the alignment of consumer preferences with sustainability goals is expected to drive innovation and growth within the smart grid market.