Rise of Digital Banking

The rise of digital banking in Spain is a pivotal driver for the nlp in-finance market. As more consumers shift towards online banking solutions, financial institutions are increasingly adopting NLP technologies to enhance customer service and streamline operations. In 2025, it is estimated that over 70% of banking transactions in Spain occur through digital platforms. This shift necessitates advanced NLP applications to analyze customer interactions, automate responses, and provide personalized services. The integration of NLP tools allows banks to process vast amounts of unstructured data, improving customer satisfaction and operational efficiency. Consequently, the nlp in-finance market is likely to experience substantial growth as banks invest in these technologies to remain competitive in a rapidly evolving digital landscape.

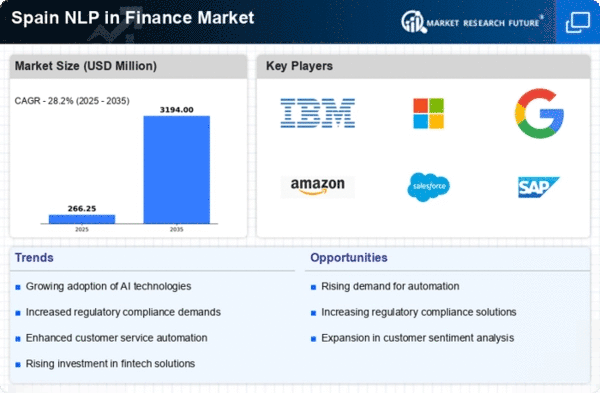

Adoption of AI and Machine Learning

The adoption of artificial intelligence (AI) and machine learning technologies is a significant driver for the nlp in-finance market in Spain. Financial institutions are increasingly recognizing the potential of these technologies to enhance their operations and customer engagement. In 2025, it is projected that the AI market in the financial sector will reach €2 billion in Spain. NLP plays a crucial role in this transformation, enabling institutions to analyze customer data, automate processes, and derive insights from unstructured information. As banks and financial services embrace AI-driven solutions, the demand for NLP applications is expected to surge, fostering innovation and efficiency within the nlp in-finance market.

Increased Demand for Fraud Detection

The increasing demand for robust fraud detection mechanisms is significantly influencing the nlp in-finance market in Spain. Financial institutions are facing rising challenges related to fraudulent activities, with losses from fraud estimated to reach €1 billion annually. NLP technologies are being leveraged to analyze transaction patterns and detect anomalies in real-time, thereby enhancing security measures. By employing machine learning algorithms alongside NLP, banks can identify potential fraud cases more effectively, reducing financial losses and improving customer trust. This growing emphasis on security is likely to drive investments in NLP solutions, as institutions seek to protect their assets and maintain regulatory compliance, further propelling the nlp in-finance market.

Regulatory Pressure for Transparency

Regulatory pressure for transparency and accountability is a critical driver impacting the nlp in-finance market in Spain. Financial institutions are required to comply with stringent regulations aimed at preventing money laundering and ensuring consumer protection. This has led to an increased focus on data analysis and reporting, where NLP technologies can facilitate the extraction of relevant information from vast datasets. By automating compliance processes, institutions can reduce the risk of penalties and enhance their operational efficiency. As regulatory frameworks continue to evolve, the demand for NLP solutions that support compliance efforts is likely to grow, thereby influencing the trajectory of the nlp in-finance market.

Growing Importance of Customer Insights

The growing importance of customer insights is shaping the nlp in-finance market in Spain. Financial institutions are increasingly recognizing the value of understanding customer behavior and preferences to tailor their services effectively. With the rise of big data, NLP technologies are being utilized to analyze customer feedback, social media interactions, and transaction histories. This analysis enables institutions to gain actionable insights, enhancing their marketing strategies and product offerings. In 2025, it is anticipated that the market for customer analytics in the financial sector will exceed €1.5 billion in Spain. As institutions strive to improve customer experiences, the demand for NLP applications that facilitate this understanding is expected to rise, driving growth in the nlp in-finance market.