Rising Demand for Smart Cities

The push towards smart cities in Spain is a pivotal driver for the internet of-everything market. Urban areas are increasingly adopting IoT technologies to enhance infrastructure, improve public services, and optimize resource management. According to recent studies, investments in smart city initiatives are projected to reach €1.5 billion by 2026, indicating a robust growth trajectory. This trend is fueled by the need for efficient energy consumption, traffic management, and waste reduction. As cities become more interconnected, the demand for IoT solutions that facilitate real-time data exchange and analytics is likely to surge, thereby propelling the internet of-everything market forward.

Increased Focus on Data Security

As the internet of-everything market expands, concerns regarding data security and privacy are becoming more pronounced in Spain. The rise in connected devices has led to a greater emphasis on developing robust cybersecurity measures. Companies are investing in advanced security protocols to protect sensitive information and maintain consumer trust. The market for IoT security solutions is projected to grow by 30% over the next five years, reflecting the urgent need for secure systems. This focus on data protection is likely to drive innovation within the internet of-everything market, as businesses seek to implement secure and reliable IoT applications.

Government Initiatives and Funding

The Spanish government is actively promoting the adoption of IoT technologies through various initiatives and funding programs. The National Plan for Digitalization aims to allocate €20 billion towards digital transformation, which includes investments in the internet of-everything market. This financial support is designed to foster innovation, enhance competitiveness, and stimulate economic growth. Additionally, public-private partnerships are being encouraged to develop IoT solutions that address local challenges. Such government backing is likely to create a conducive environment for startups and established companies alike, thereby accelerating the growth of the internet of-everything market.

Growing Consumer Awareness and Adoption

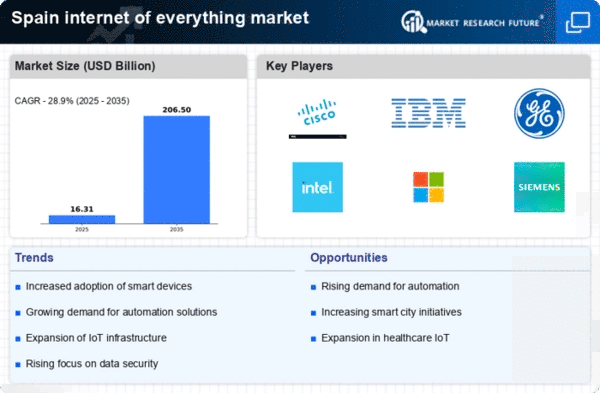

Consumer awareness regarding the benefits of IoT technologies is steadily increasing in Spain, which is a significant driver for the internet of-everything market. As individuals become more informed about smart home devices, wearables, and connected appliances, the demand for these products is expected to rise. Market Research Future indicates that the smart home segment alone could reach €3 billion by 2025. This growing consumer interest is likely to encourage manufacturers to innovate and expand their offerings, thereby enhancing the overall landscape of the internet of-everything market.

Advancements in Telecommunications Infrastructure

Spain's telecommunications infrastructure is undergoing significant enhancements, which is crucial for the internet of-everything market. The rollout of 5G technology is expected to provide faster and more reliable connectivity, enabling a wide array of IoT applications. With an estimated 80% of the population projected to have access to 5G by 2027, the potential for IoT devices to communicate seamlessly increases. This advancement not only supports consumer applications but also industrial IoT solutions, which are anticipated to grow by 25% annually. Enhanced connectivity is essential for the proliferation of smart devices, thus driving the internet of-everything market in Spain.